Our best spreads and conditions

About platform

About platform

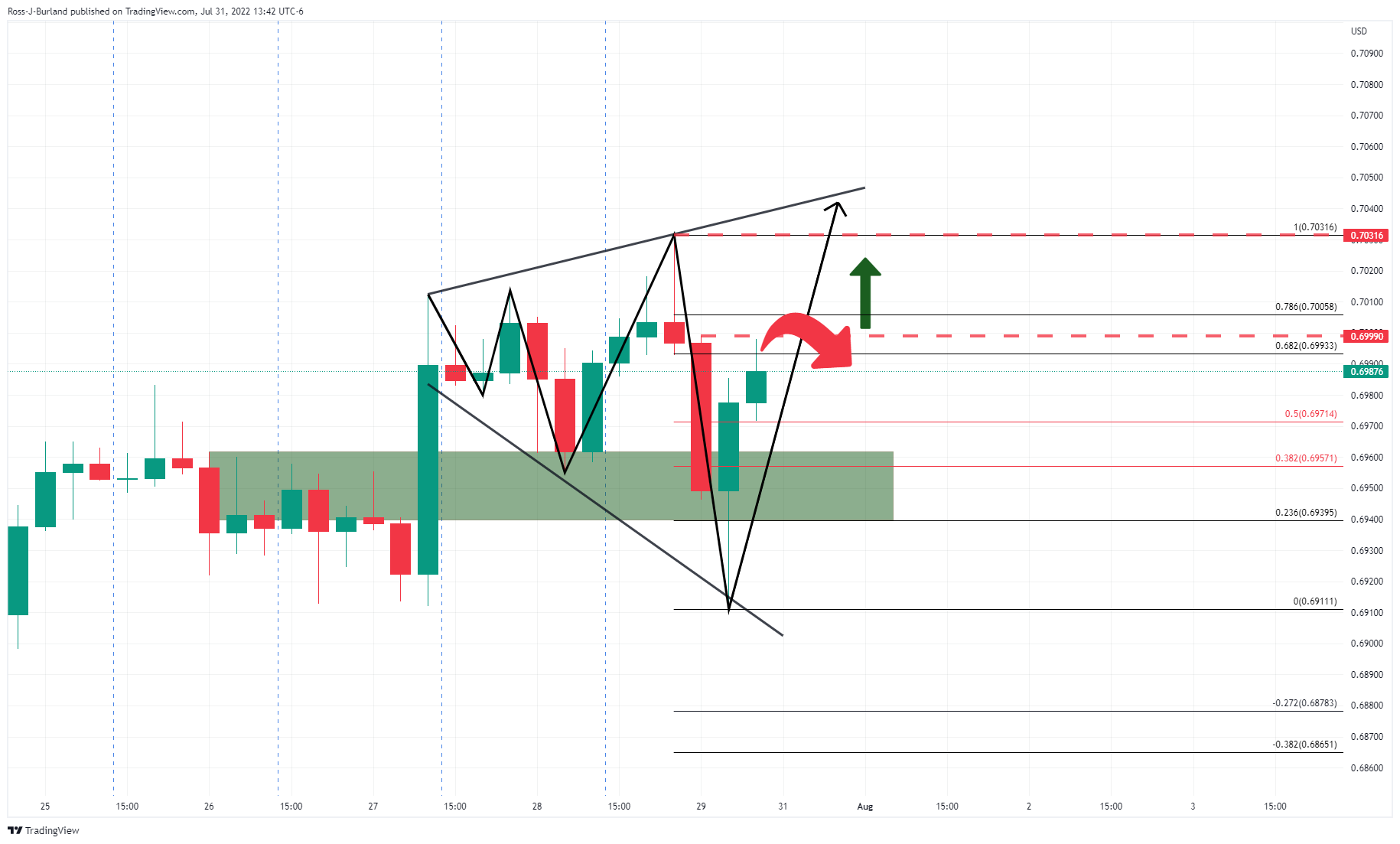

AUD/USD is setting up for a compelling bullish scenario for the open, although the weekly chart's W-formation offers the risk of a significant reversion.

The price has been carving out a broadening formation and should the bulls commit, then there is room to go to the upside for the week ahead.

However, the weekly chart's W-formation is worth noting as a potential hindrance with the 50% mean reversion level aligning with the neckline of the pattern.

For the open, the bulls could well emerge from the presumed support base and the confluence of the 50% mean reversion area and a prior hourly high/resistance. A bullish extension of the prior hourly impulse could see the bulls in charge all the way into the 0.7000s in the very near term.