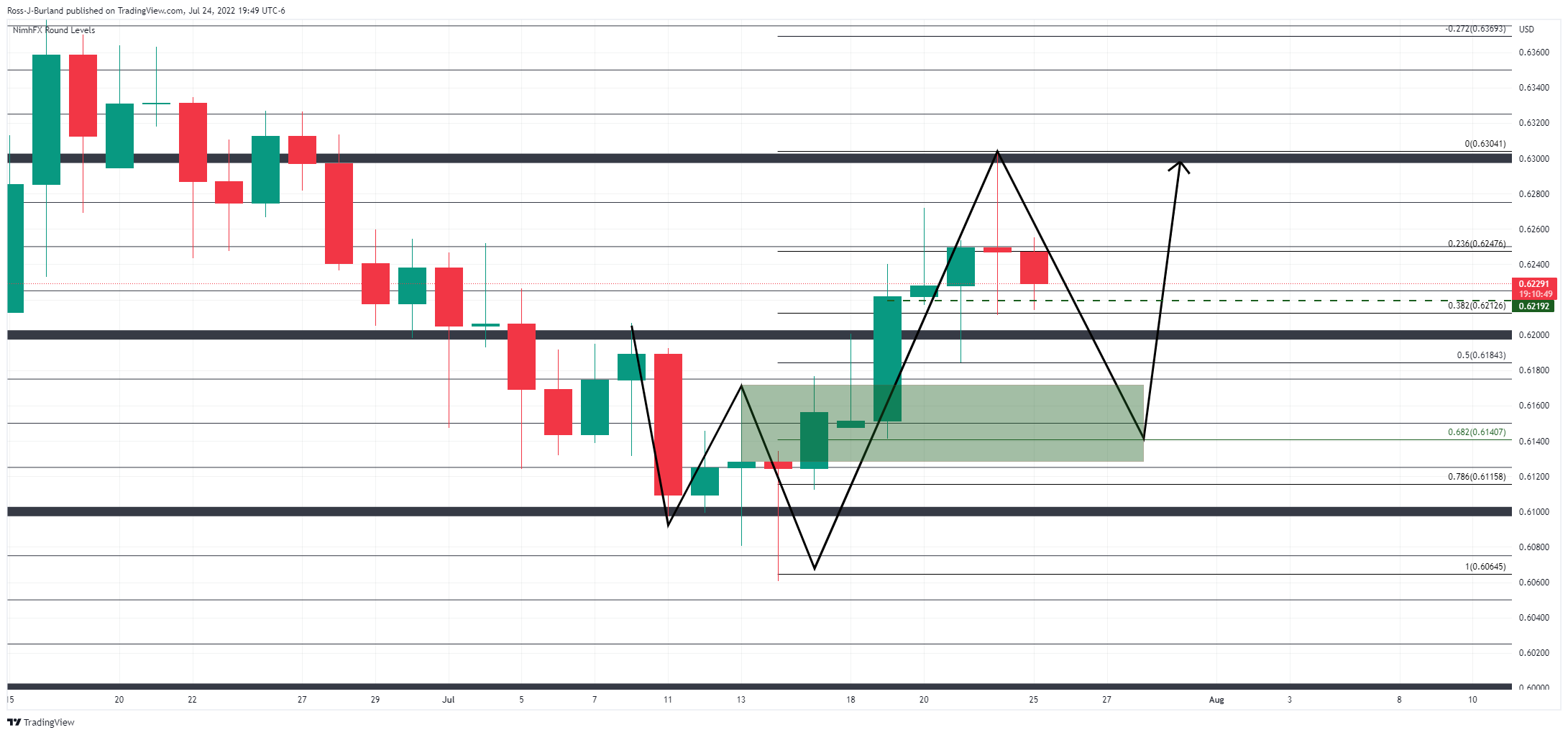

NZD/USD Price Analysis: Bears eye a move towards 0.6150

- NZD/USD bears move in to test the commitment of the bulls.

- The daily W-formation is a reversion pattern that exposes 0.6150.

NZD/USD was on the front foot vs. the greenback at the end of the week despite the risk-off flows into the greenback. It was down for the day but it had the most positive week since May 23. With that being said, this leaves scope for a significant correction in the days ahead as we move toward this week's FOMC meeting.

Another 75bp Fed funds rate hike is fully priced by markets so that does give room for the kiwi to recover but the following daily chart's features are compelling:

NZD/USD daily chart

The price has left a W-formation which is a reversion pattern. The rejection from the round 0.63 figure was firm followed by today's bearish candle. Bears will be looking to see if this does indeed finish as an engulfment for a further conviction that the price is headed back into test 0.6150 and below.