GBP/USD Price Analysis: Sellers could be about to make their moves

- GBP/USD bears are showing up at the start of the week.

- The sellers could be sitting on dry powder with eyes on 1.1900.

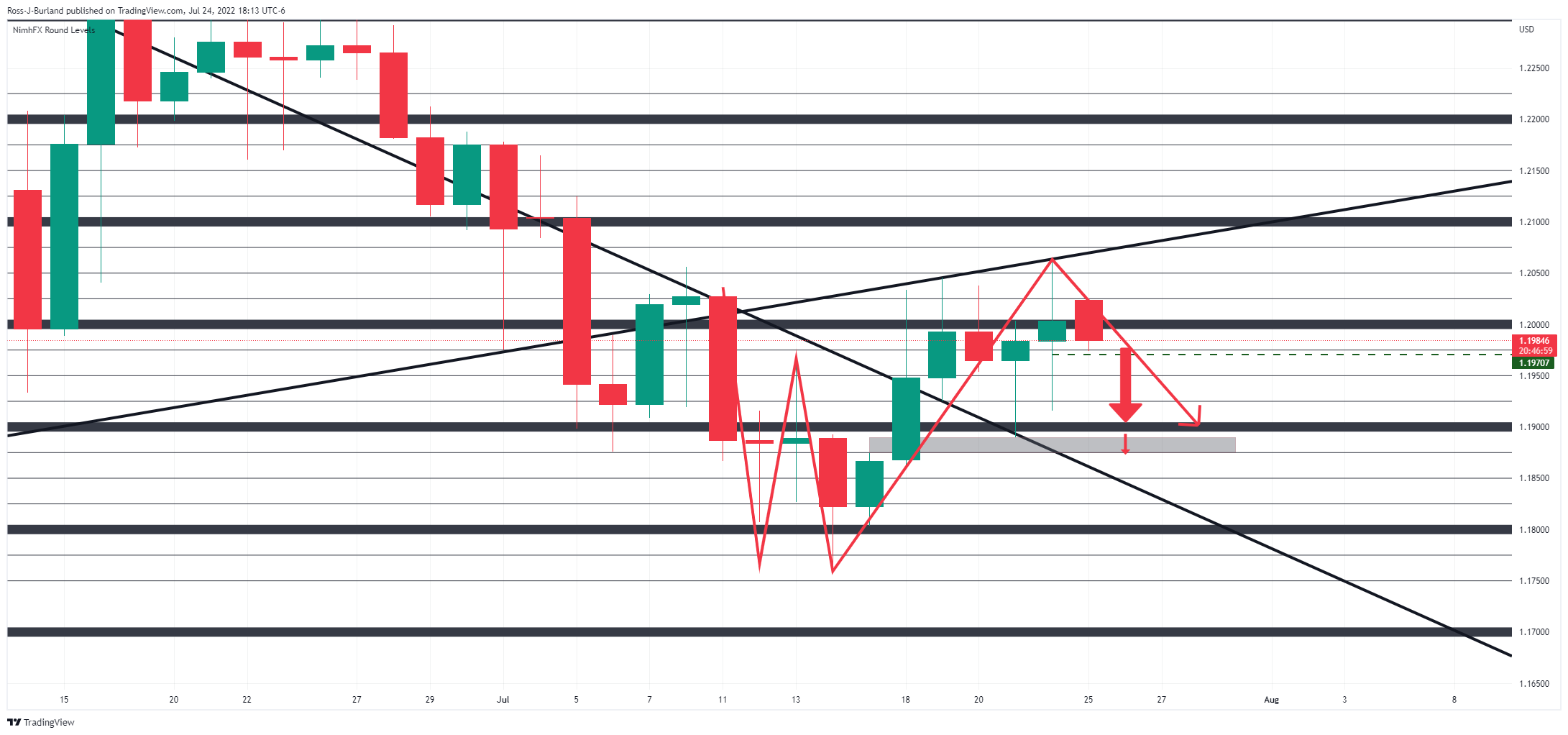

GBP/USD is under pressure in the open as the US dollar picks up a bid to start the week. The following illustrates the structure of the hourly market as per round numbers, the broadening formation and a price imbalance.

GBP/USD H1 chart

The price imbalance is the greyed area on the chart above the price where the bulls have yet to turn up at the start of the week. A retracement to fill the void would be expected in due course. The scenario above presumes that the price will be pulled towards liquidity prior to the next significant move lower below prior lows and support.

GBP/USD daily chart

The daily chart shows that the price has already retraced to the W-formation's neckline although there could still be plenty of sellers on the sidelines according to the wicks and a fuller retest of the neckline near 1.1900 could be in order.