AUD/USD Price Analysis: Fresh houly highs on the horizon as price mitigates imbalance

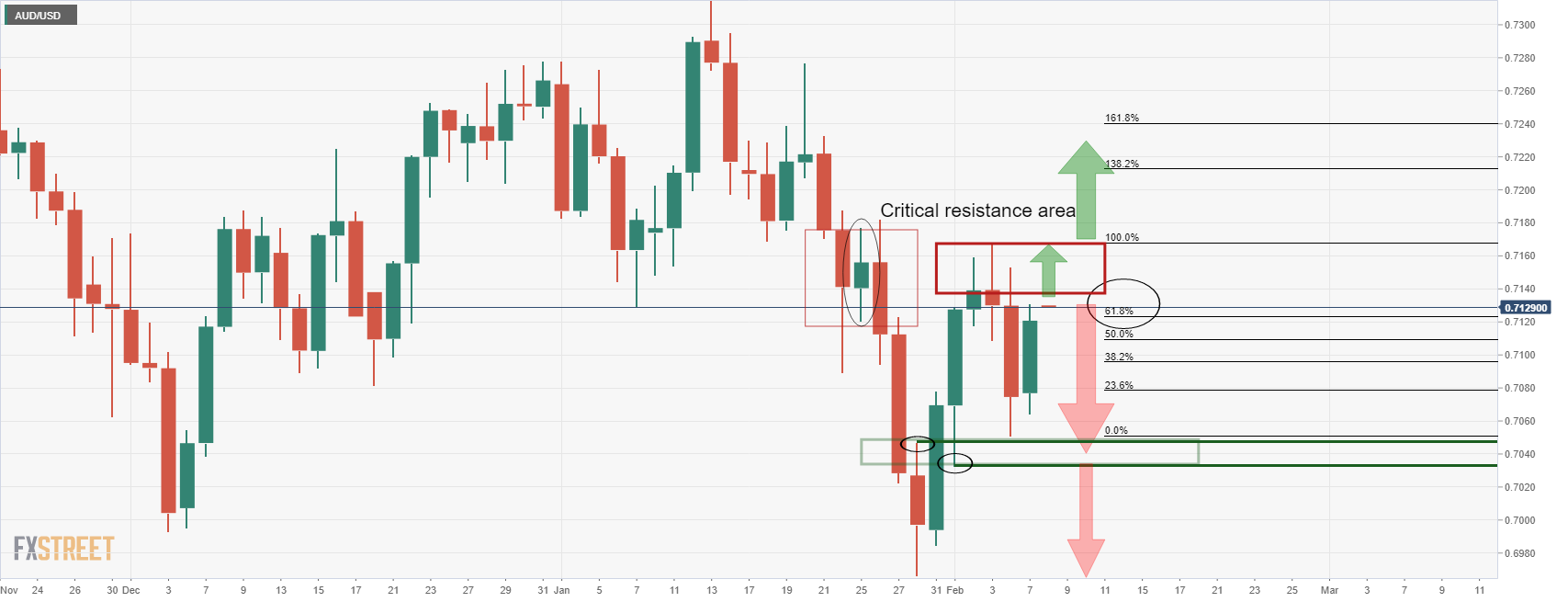

- AUD/USD bulls move in on a critical resistance structure.

- Eyes are on the weekly M-formation's neckline.

AUD/USD bulls are taking charge in the Asian session and are printing fresh hourly highs for the week's business so far:

Meanwhile, as per the prior analysis, AUD/USD Price Analysis: Bears sink their teeth into US Nonfarm Payrolls, we have seen mitigation taking place on the daily charts. The bears will not need to show up if the downside thesis is going to play out in the near future.

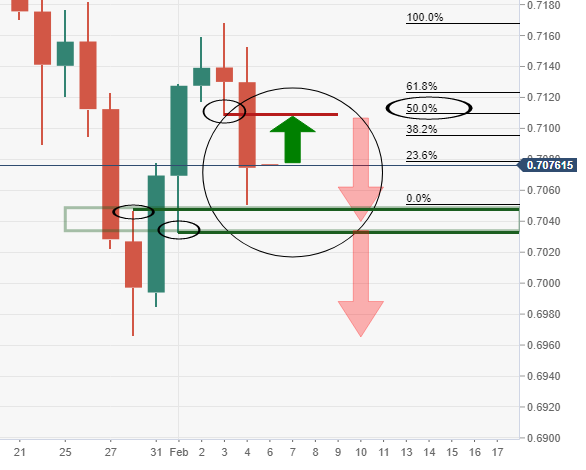

AUD/USD prior analysis

At the start of the week's price analysis, it was stated that there was the potential for the mitigation of the markdown and the imbalance thereof:

This has played out, but the bulls have run with it and taken o the 61.8% retracement of the prior bearish impulse:

AUD/USD live market

AUD/USD weekly chart

The bears will be lurking now and if they commit, then the completion of the M-formation's retracement to the neckline on the weekly chart will tilt the bias back into the bear's hands once again.