Back

24 Jan 2022

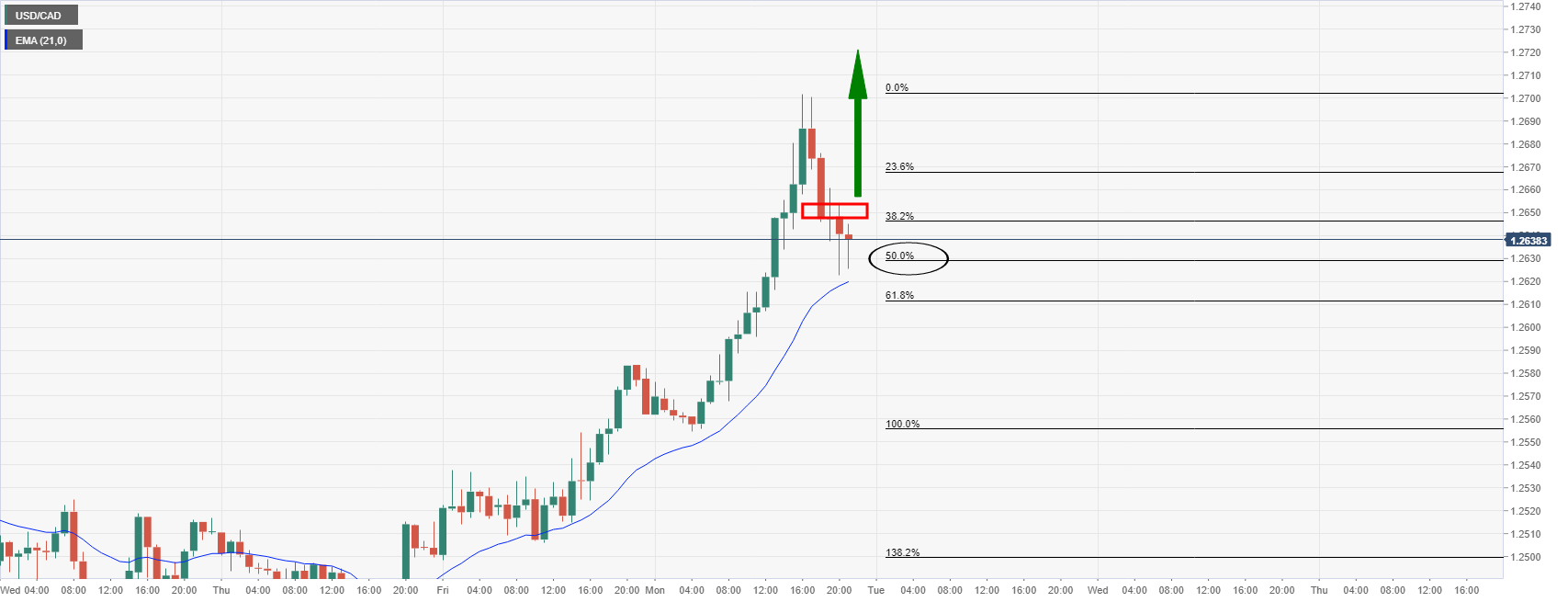

USD/CAD Price Analysis: Bulls looking for a discount from an hourly correction, eye 1.2720

- USD/CAD bears looking for a strong correction to the neckline of the W-formaiton.

- Bulls are seeking an upside extension from the hourly correction at a discount.

The price of USD/CAD has corrected back to test the 50% mean reversion mark and is decelerating. This leaves prospects of a bullish continuation on the cards for the sessions ahead.

USD/CAD H1 chart

The bulls would target the 1.2720s as being a -0.272% bullish Fibo extension target that aligns with the prior resistance structure as per the daily chart below:

USD/CAD daily chart

The W-formation is a reversion pattern and the price, after filling the wick of yesterday's business with some change, would be expected to revert back to test the neckline of the 'W' pattern. This would align with a 61.8% golden ratio as well near to 1.2560.