Indeks Dolar AS Tetap Tertekan, Tantang 96,00

- DXY diperdagangkan defensif di dekat 96,00.

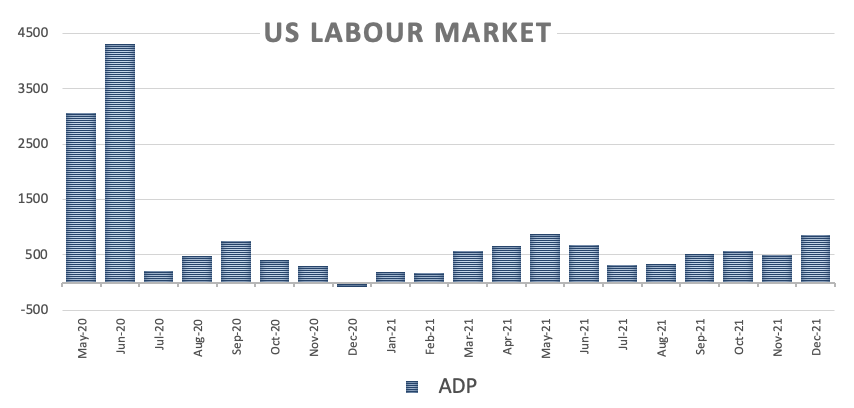

- Laporan ADP AS secara mengejutkan naik pada bulan Desember.

- Perhatian investor saat ini bergeser ke Risalah FOMC.

Indeks Dolar AS (DXY), yang mengukur greenback versus sekumpulan saingan utamanya, diperdagangkan defensif dan dekat lingkungan 96,00 pada hari Rabu.

Indeks Dolar AS sekarang mengamati FOMC

Indeks tetap tidak dapat membalikkan kebangkitan tekanan jual sejauh ini dan bergerak di ujung bawah kisaran harian dan tidak juah dari tolok ukur utama 96,00.

Kurangnya keyakinan dalam imbal hasil AS di tengah kinerja beragam di seluruh kurva dan bias investor terhadap kompleks risiko membuat dolar tetap di bawah pengawasan meskipun hasil dari laporan ADP pada bulan Desember menggembirakan.

Memang, sektor swasta AS menambahkan 807 ribu pekerjaan selama bulan lalu, mengalahkan estimasi kenaikan 400 ribu dan naik dari 505 ribu di November.

Di sesi ini, Markit akan merilis IMP Jasa final untuk bulan Desember dan FOMC akan menerbitkan Risalah pertemuan terakhirnya.

Level-level relevan Indeks Dolar AS

Sekarang, indeks mundur 0,30% di 95,99 dan penembusan di atas 96,46 (tertinggi mingguan 4 Januari) akan membuka kemungkinan ke 96,90 (tertinggi mingguan 15 Desember) dan 96,93 (tertinggi 2021 pada 24 November). Di sisi lain, penghalang berikutnya muncul di 95,57 (terendah bulanan 31 Desember) diikuti oleh 95,51 (terendah mingguan 30 November) dan kemudian 94,96 (terendah mingguan 15 November).