Back

2 Aug 2021

Natural Gas Futures: Positive stance looks unchanged

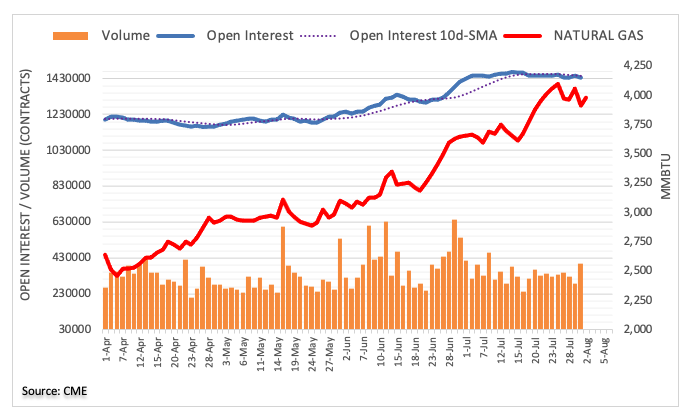

Advanced prints from CME Group for natural gas futures markets showed open interest dropped by more than 15K contracts on Friday after two daily builds in a row. On the flip side, volume reversed two straight daily drops and went up by around 110.2K contracts.

Natural gas stays capped by $4.20 so far

Friday’s pullback in prices of natural gas was accompanied by shrinking open interest, somehow limiting further retracements in the very near term at least. The resumption of the upside appears probable with the immediate target at the $4.20 mark per MMBtu.