Our best spreads and conditions

About platform

About platform

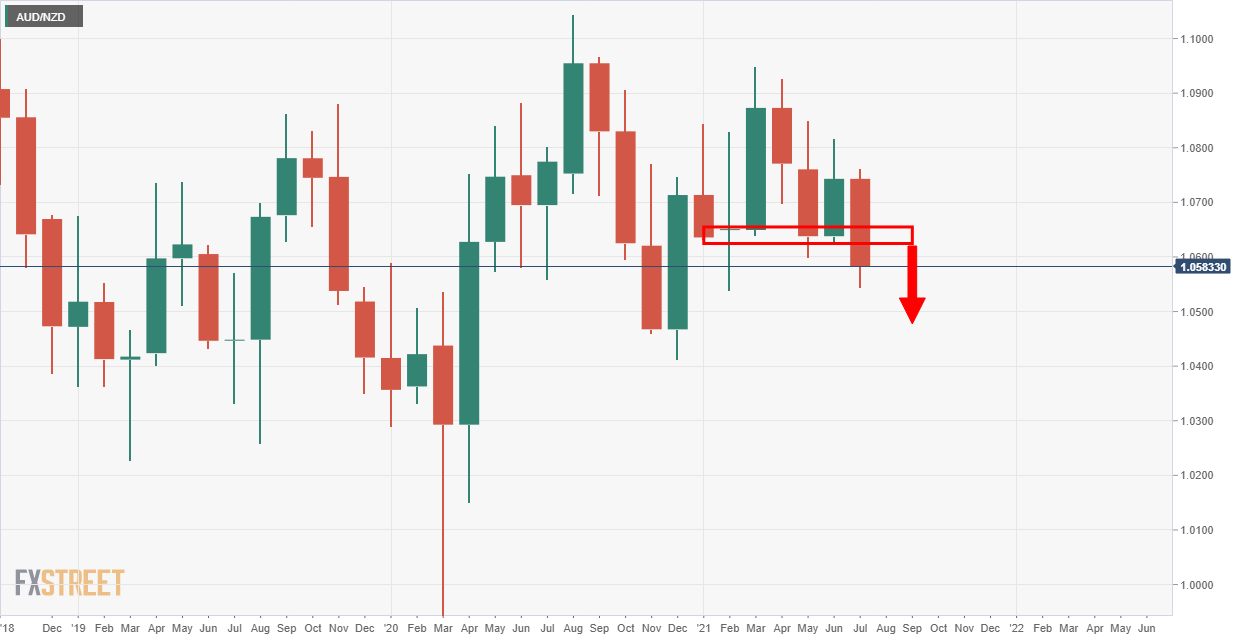

AUD/NZD is carving out prospects of an upside correction, but there are limitations to how far the cross might correct until the bears will pounce.

The following is a top-down analysis that illustrates the medium-term bearish bias vs prospects of a meanwhile bullish correction.

The monthly chart shows that the price is on the verge of a bearish close, but there is still plenty of days before the end of the month to go and the potential for a restest of the 1.0620's prior month's low.

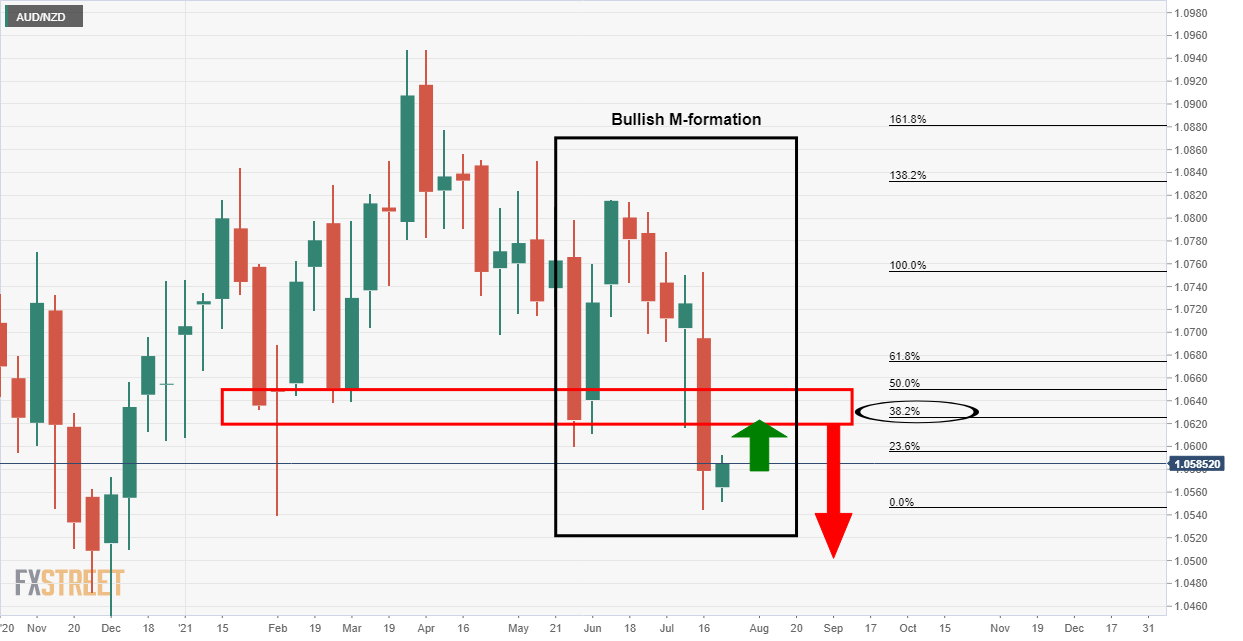

From a weekly perspective, the bulls are currently correcting last week's bearish impulse and there could be more on the cards.

The M-formation is a high completion rate pattern where the price would be expected to test at least the 38.2% Fibonacci retracement which has a confluence of prior lows near 1.0620.

The bears, at which point, will be on the lookout for bearish conditions from which to short and target a downside extension towards the first half of 2020's business resistance between 1.0505/30.

The daily chart pinpoints the weekly resistance, but there are also prospects of a deeper correction given the divergence of the 10 and 21 EMAs from the 38.2% Fibo as follows:

In the above scenario, the bulls could well engage at the first resistance and take on the bears, pushing them back into where the next layer of resistance.

This is where the resistance would be expected to align with the convergence of the 10 and 21 EMAs as well as the 50% mean reversion, if not the 61.8% Fibonacci.

With all that said and done, however, considering the divergence between the two central banks, the bears could well step in a lot sooner, so fading from the late May lows should be monitored for bearish structure and shorting opportunities: