NZD/USD bulls stepping in at daily support

- NZD/USD bounced into the close on Wall Street, albeit 0ver 0.8% underwater.

- Price meets starts to correct from the bearish territory for early Asia.

NZD/USD is trading down by some 0.8% at the time of writing, falling from a high of 0.7003 to a low of 0.6915 on the day so far, correcting into the Wall Street close.

A sharp risk-off tone sent the Aussie off a cliff at the start of the week as worries about the Delta variant spread, a theme forecasted in the following early Asia article that can be read here:

- COVID spread weighing on market's risk appetite

Consequently, global shares dropped and fixed income rallied. The higher beta currencies, such as the Kiwi, maintained their weaker bias.

Today, the Vix is back above 20, soaring to a fresh daily high of 24.78 from 19.27 the low. The S&P 500 was closing Wall Street down over 1.5%.

Risk-off sentiment supported the USD. DXY is up for the third straight day and it has traded at its highest level since April 5 near 93, not far off the March 31 and YTD high near 93.437.

''Learning to live with COVID is not being enthusiastically embraced amid the spread of the Delta variant,'' analysts at ANZ bank said.

''With primary data releases absent this week and Federal Reserve speakers in blackout ahead of next week’s FOMC meeting, the NZD will be driven primarily by risk appetite.''

Specifically with regards to the covid fears, ''despite the vaccine rollout, markets do not appear to be embracing the idea of learning to live with COVID-19,'' the analysts said.

''Sentiment appears to have shifted, at least for the moment, to a persuasion that growth and earnings expectations may be overdone. With so much good news and optimism having been priced this year, an adjustment to sentiment is not an uncommon occurrence, particularly as the pendulum is slowly swinging towards less accommodative monetary settings.''

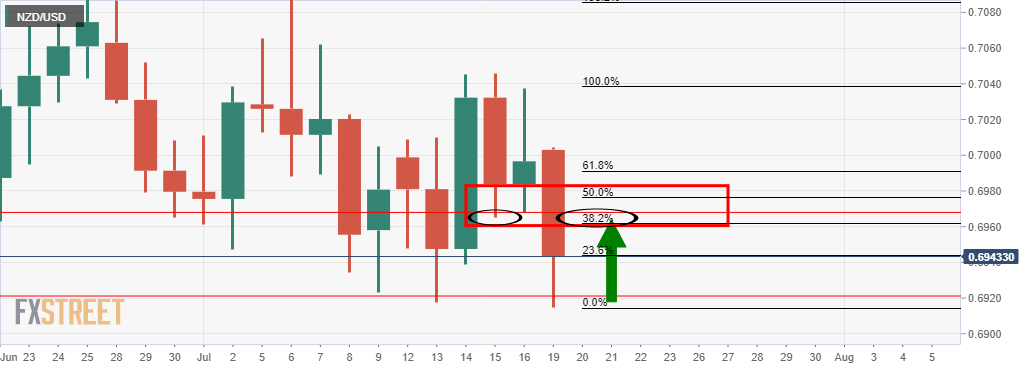

NZD/USD technical analysis

The price was sent to the lower end of the daily range vs the US dollar at the start of the week.

This leaves a potentially bullish case on the cards for the days ahead should the price now correct considering the M-formation on the daily chart: