GBP/JPY Price Analysis: Bulls looking to retest of weekly resistance

- GBP/JPY bears are in control, but weely support could result in a meaningful correction.

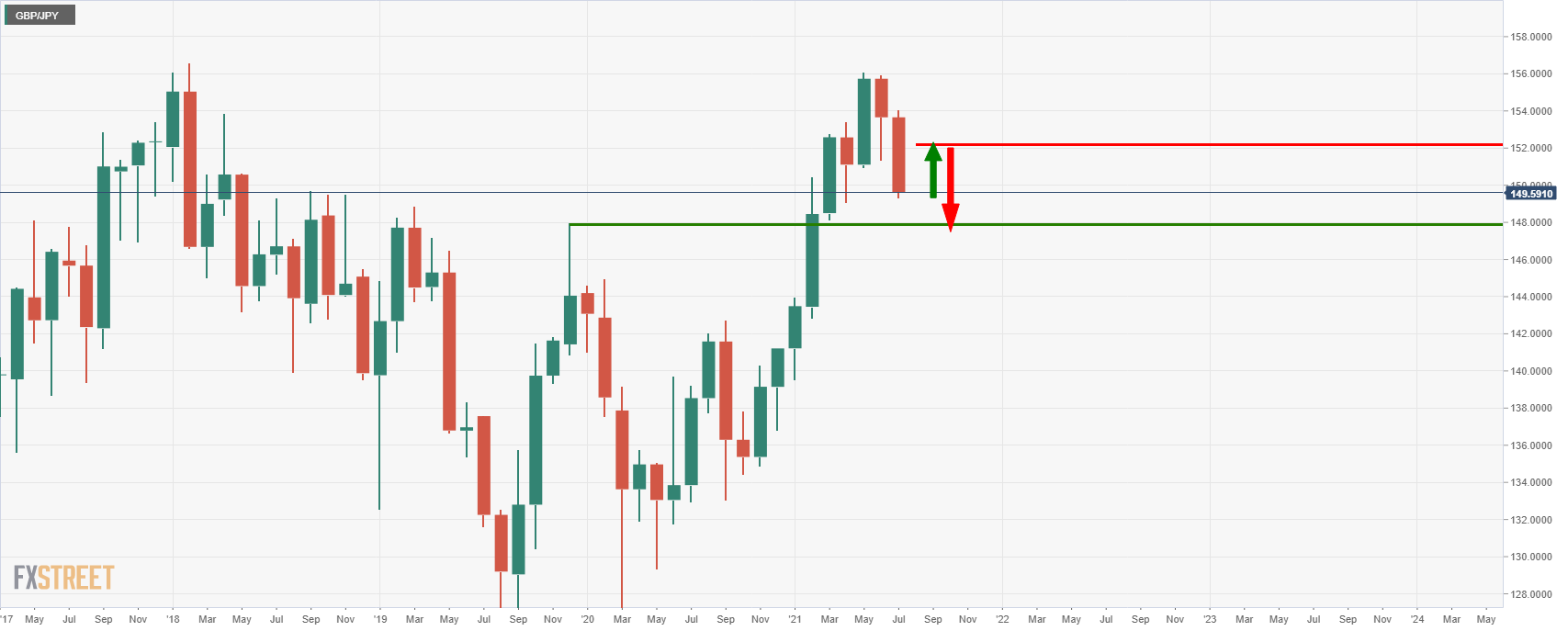

- Monthly prospects are bearish towards a lower low and prior resistance.

The yen is picking up a safe-haven bid in the open of the week pertaining to fear of the delta variant spreading worldwide.

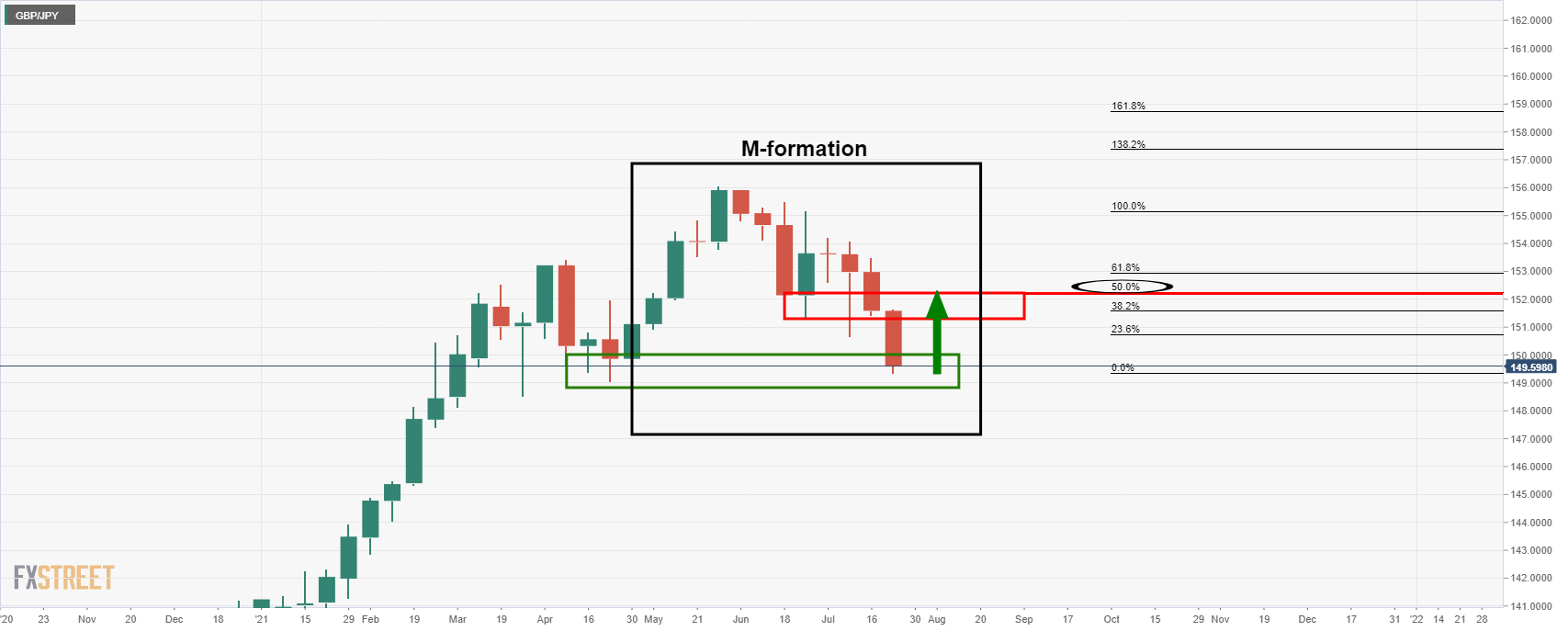

However, from a technical standpoint, the price of GBP/JPY is meeting weekly support, so there is a case for a meanwhile bullish correction presenting itself.

On the weekly chart, specifically, a bullish chart pattern is also compelling in the form of a bullish M-formation as follows:

As illustrated, the price is indeed testing the bullish commitments in the weekly demand area.

The last time the price was this low, bulls took the market to fresh monthly highs, so it is likely to be a strong area of meanwhile support.

A 50% mean reversion aligns with the prior weekly closing lows and open as a higher probability resistance area for the bulls to target near 152.20.

Below there, however, is the 38.2% Fibo near 151.60 which could equally act as resistance.

The monthly close will be important, but the current state of affairs is bearish below 150.80 towards 147.90: