WTI bulls holding the fort below trendline resistance

- Oil prices are retesting the counter trendline, ignoring dollar strength.

- Bears may well gather in numbers below current hourly support.

- Demand dominates while energy bulls step over dollar strength.

Oil prices fell for a second day early on Friday with the greenback extending its gains across both the forex board and the commodities space in general. However, West Texas Intermediate (WTI) crude oil started to rise later in the day and was ending Friday higher by over 0.5% despite the strength in the US dollar.

Spot WTI rose from a low of $70.18 to a high of $72.14 ending the day at $71.41. As for futures, WTI crude for July delivery settled up US$0.60 to US$71.64 per barrel. At the time of writing, WTI is trading 0.35% hitherto 471.66 from the lows of $71.41 and has reached a high of $71.71 so far on the session.

The markets are consolidating last week's action that followed the Federal Reserve's switch to a more hawkish monetary policy on expectations of higher demand.

Amid controlled supply from the OPEC+ group and holidays as a big majority of the global population emerges from lockdown, oil demand is recovering from pandemic lows as gasoline and aviation fuel use rise. Stemming the advance, however, could be blamed on US oil production prospects with the Baker-Hughes weekly rig count advancing.

Analysts at TD Securities are expecting a Summer Breakout to unfold as a global vaccination rollout drives mobility sharply higher this summer, while OPEC's cautious plan to raise output should tighten the market with considerable deficits expected in the coming months.

''In this context, our gauge of energy supply risk continues to trend higher, with supply artificially constrained amid lingering negotiations with Iran and a cautious OPEC+. However, this set-up should drain oil inventories towards the critical benchmarks set by the 2015-19 average levels by July, which could prompt OPEC+ to ramp up the pace on the unwind of their deal.''

WTI technical analysis

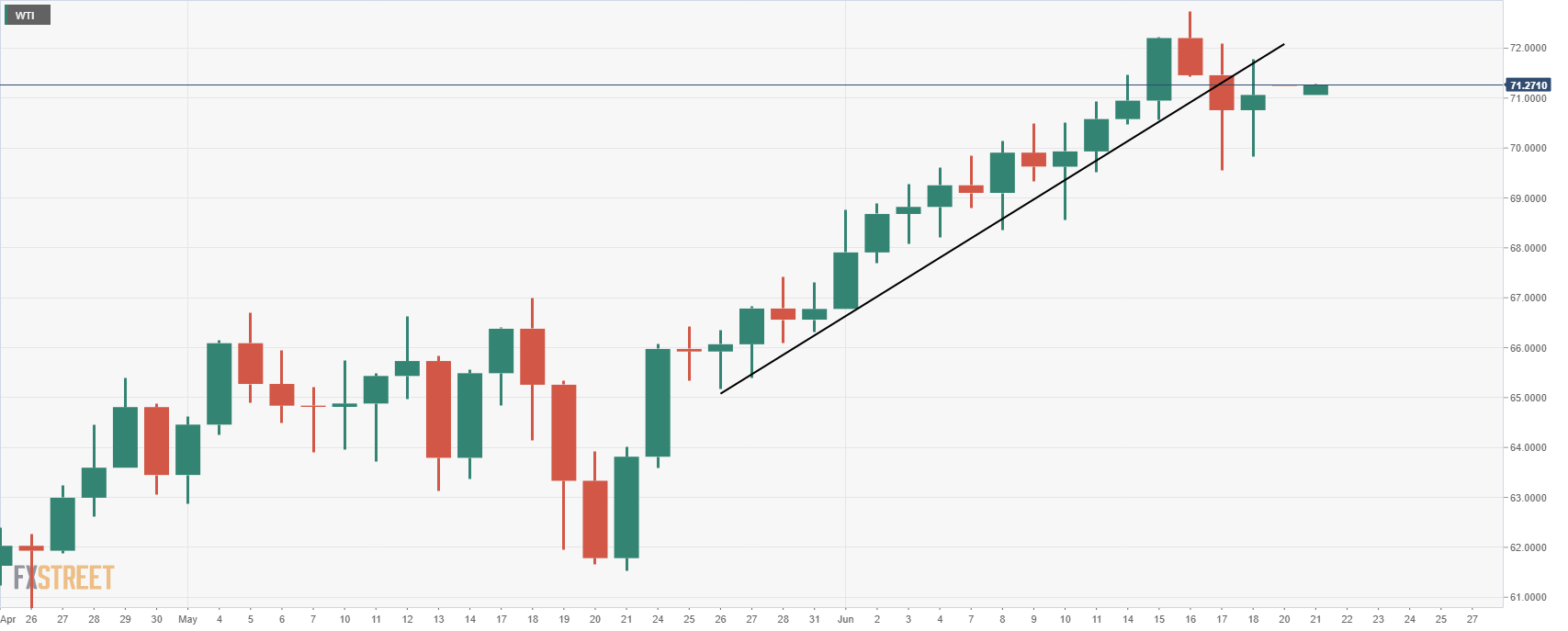

Technically, the price has pierced below the dynamic daily trendline support and has retested it as a counter trendline.

The bulls stepped in at the 8th June range and old resistance will come back under pressure this week if the bulls cannot regain territory above the daily counter trendline. 72.41 is important in this regard.

From an hourly perspective, the price could be on the verge of an additional retest, the bearish bias persists, especially below the 21-EMA and 38.2% Fibo confluence of support.