Our best spreads and conditions

About platform

About platform

Gold prices collapsed through daily support by over 5.2% since Fed Chair Powell described this week's Federal Open Market Committee meeting as the 'talking about talking about' meeting.

Gold bugs now fear that members are now seeking a plan to reduce the pace of QE and they have started to bail ship.

Crucially, the members are also bringing forward their projections from flat to +50bp in rate hikes by end-2023.

The combination has continued to percolate through markets with knee jerk reactions in the US dollar.

The DXY has powered ahead is trading at the highest since April 13, taking on the 92 level with a high after easily breaking above the 200-day moving average near 91.538.

Bulls now have sights on a test of the March 31 high near 93.437.

However, one of the key takeaways from the meeting for gold markets was the reaction in the 10-year breakeven inflation rates that are down 6 bp on the hawkish hold.

''That is, the market has even more confidence that the Fed won't let inflation get out of hand. With the 10-year yield up 7 bp, the real yield has risen 14 bp to -0.76%, the highest since April 19. This is dollar-positive and we think there's room to go even higher,'' analysts at Brown Brothers Harriman explained.

The PCE factor and uncertainty among the members was an important takeaway also.

Analysts at TD Securities explained that this suggests ''the Fed isn't behind the curve by any means, which leaves us in a scenario where the upside story for gold is tied to an unwind of Fed pricing that is too hawkish.''

''If inflation turns out to be truly transitory, the Fed should be happy to walk the hiking signals back. Unfortunately for gold bugs, underlying inflation trends will remain distorted for months — which removes the immediate impetus for buying the yellow metal,'' the analysts explained.

''Considering that gold was set-up for a pullback like a speed bump on the racetrack, with speculative and physical flows slowing, the pullback has room to run. However, CTAs are only set to add to their shorts below $1740/oz.''

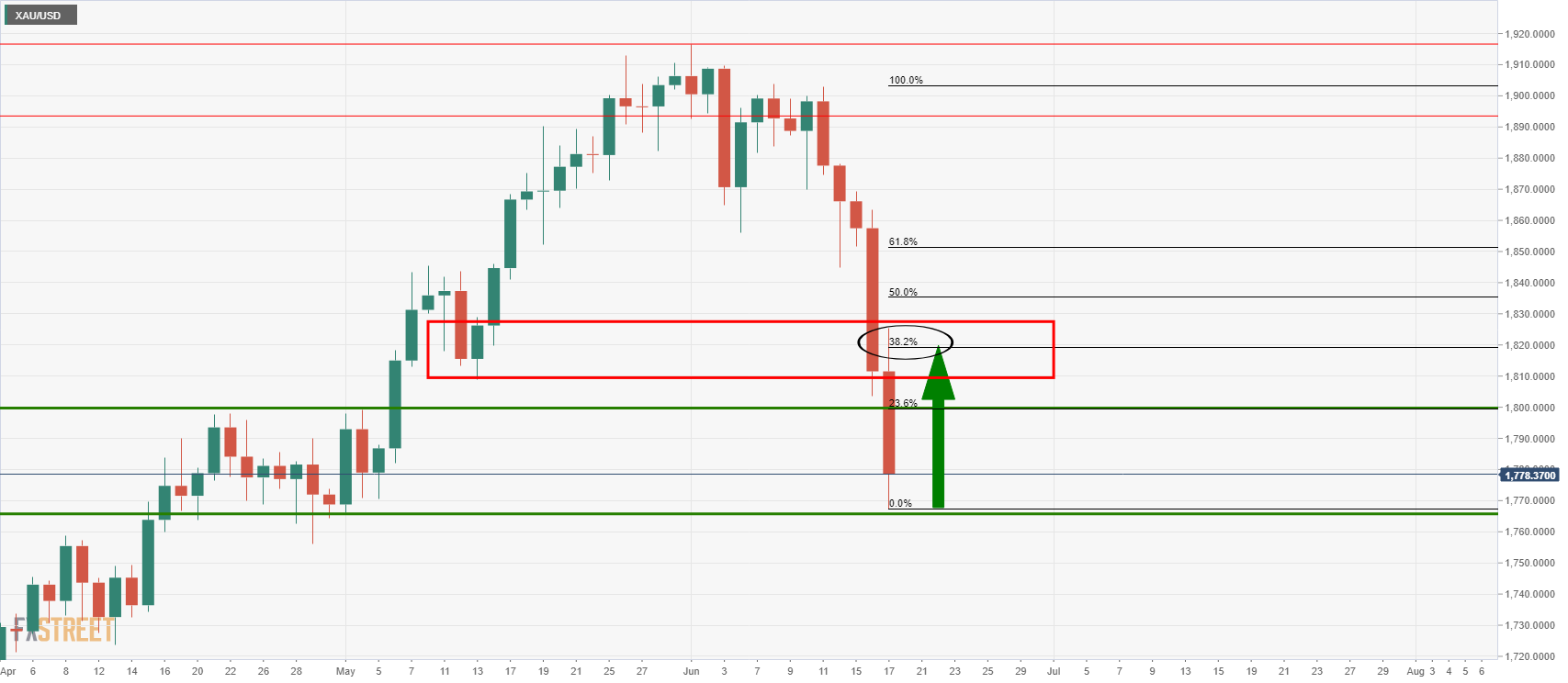

Meanwhile, from a technical perspective, the bulls are stepping in at a critical area of support.

This is a key area of liquidity that dates back to 2011.

Bulls have started to pick the low hanging fruit in New York following the final shakeout of weak hands.

The bid comes in ahead of the last day of the week as squaring of books would be expected to see profit-taking ramp up.

From a daily perspective, the price would be expected to correct at least to the prior structure with a confluence of the 38.2% Fibonacci retracement area.