USD/TRY climbs to multi-day highs near 8.7000

- USD/TRY pushes higher and approaches the 8.70 area.

- No surprises after the CBRT kept the steady hand at its meeting.

- Dollar’s improved mood also helps with the upside in the pair.

The Turkish lira depreciates further and now lifts USD/TRY to fresh multi-day highs around 8.670.

USD/TRY weaker on USD-rally, CBRT inaction

USD/TRY advances uninterruptedly since Monday and almost fully retraced last week’s drop to as low as the 8.28 zone (June 11).

The lira started the week on the defensive and intensified the selling bias after the Biden-Erdogan meeting yielded no progress regarding Turkey’s purchase of Russian S-400 defence missile system on Tuesday.

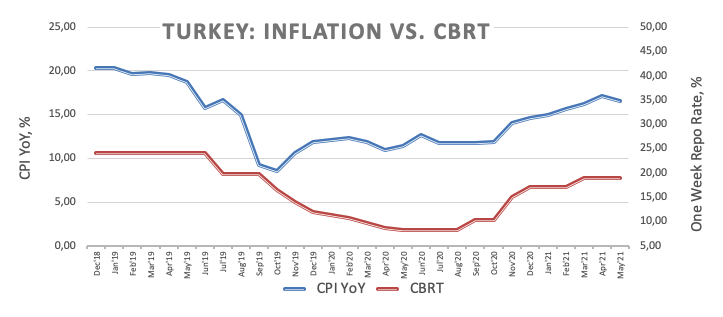

Extra weakness in the currency turned up today following the decision by the Turkish central bank (CBRT) to leave the One-Week Repo Rate unchanged at 19.00%. In the statement, the central bank reiterated that both inflation and inflation expectations remain high, while the level of the policy rate will be determined above the inflation.

In addition, the strong buying interest in the dollar in the wake of the FOMC event on Wednesday also lends extra wings to the weekly leg higher in spot.

What to look for around TRY

The outlook for the Turkish lira continues to deteriorate almost on a daily basis, as rumours of interest rate cuts keep running in the background and remain supported by the Erdogan’s administration. Despite inflation appears to have peaked in April, it still remains (very) high and a move on rates in the short-term horizon seems to have lost some motivation for the time being. In the meantime, political effervescence within the ruling AK Party, the impact of the pandemic on the economic outlook, high unemployment and the so far utter absence of any intentions to implement the much-needed structural reforms remain poised to keep the lira under perseverant pressure.

Eminent issues on the back boiler: Potential US/EU sanctions against Ankara. Government pressure on the CBRT vs. bank’s credibility/independence. Bouts of geopolitical concerns. Much-needed structural reforms. Growth outlook vs. progress of the coronavirus pandemic. Capital controls? The IMF could step in to bring in financial assistance.

USD/TRY key levels

So far, the pair is gaining 1.03% at 8.6793 and faces the next resistance at 8.7472 (all-time high Jun.4) ahead of 9.0000 (round level). On the other hand, a drop below 8.3569 (50-day SMA) would aim 8.2803 (monthly low Jun.11) and finally 8.2161 (low May 7).