Back

15 Jun 2021

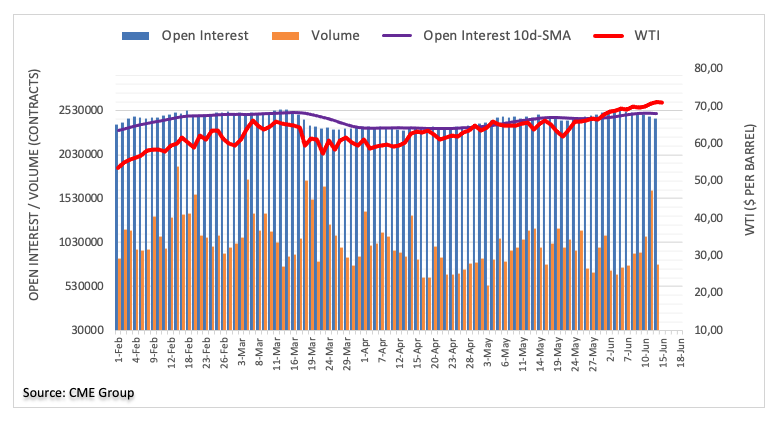

Crude Oil Futures: Corrective move in the offing

CME Group’s flash data for crude oil futures markets showed traders trimmed their open interest positions by nearly 22K contracts on Monday, reaching the sixth consecutive daily pullback. In the same line, volume went down sharply by almost 838K contracts for the first time since June 4.

WTI remains overbought

Prices of the WTI reached new tops beyond the $71.00 mark per barrel at the beginning of the week. The move was against the backdrop of the continuation of the downtrend in open interest, removing some strength from further upside. The current overbought condition of the commodity reinforces the view of a potential knee-jerk in the very near term.