Our best spreads and conditions

About platform

About platform

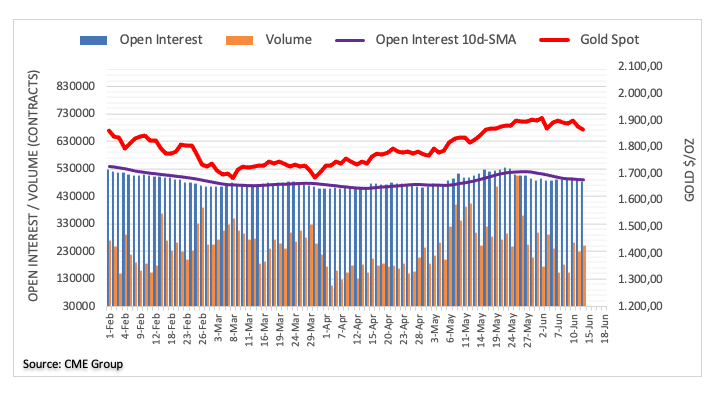

Open interest in gold futures markets shrank for the second session in a row on Monday, this time by around 8.2K contracts considering preliminary figures from CME Group. On the other hand, volume extended the erratic performance and rose by around 21.2K contracts.

Monday’s negative price action was amidst shrinking open interest, noting that further pullbacks are not favoured in the very near term at least. That said, gold still finds decent support in the $1,850 area per ounce troy, where sits the key 200-day SMA.