Back

31 May 2021

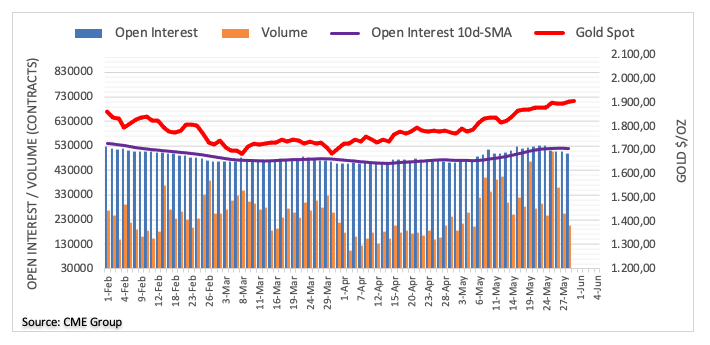

Gold Futures: Correction lower in the pipeline

Open interest in Gold futures markets shrunk for the fifth consecutive session on Friday, this time by around 9.2K contracts considering preliminary readings from CME Group. In the same line, volume went down for the third session in a row, now by around 48.3K contracts.

Gold still targets the $2,000 mark

The rally in the precious metal remains well and sound so far. Friday’s uptick, however, was on the back of shrinking open interest and volume, opening the door to some corrective move in the very near-term. This view is also underpinned by the current overbought conditions of the metal. In the longer run, gold keeps targeting the psychological $2,000 mark per ounce.