Back

19 May 2021

Gold Futures: Rally might take a break

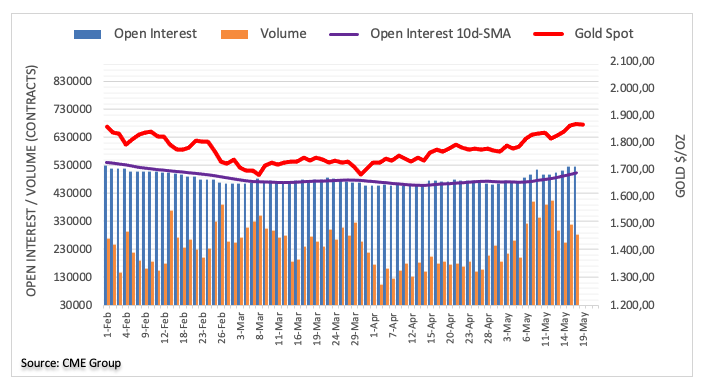

Open interest in Gold futures markets shrunk by around 1.6K contracts after three consecutive daily builds on Tuesday, noted preliminary figures from CME Group. In the same direction, volume reversed the previous day’s advance and went down by around 35.9K contracts.

Gold move into overbought levels

The rally in gold prices faltered ahead of the $1,880 mark on Tuesday. The move to new tops, however, was amidst shrinking open interest and volume. That, plus the current overbought conditions in the metal (as per the daily RSI) is indicative that a correction lower could be shaping up in the very near-term.