Our best spreads and conditions

About platform

About platform

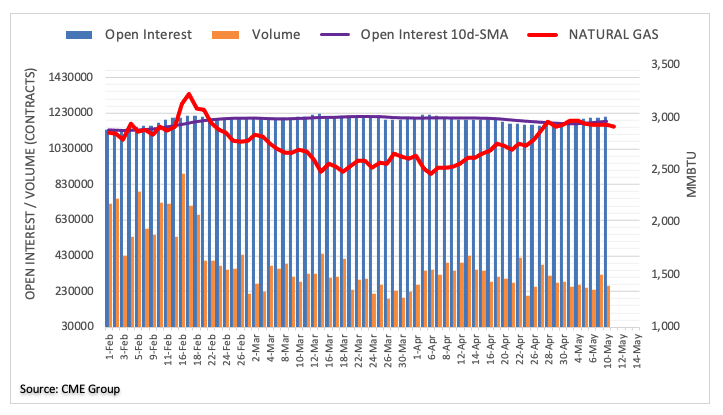

CME Group’s advanced figures for Natural Gas futures markets noted open interest rose for yet another session on Monday, this time by nearly 5.2K contracts. On the other hand, volume went down by around 60.8K contracts, partially reversing the previous build.

Natural Gas started the week on a negative footing amidst increasing open interest. That said, the door stays open for further correction lower, while the upside still faces a tough barrier around the key $3.00 mark per MMBtu.