Our best spreads and conditions

About platform

About platform

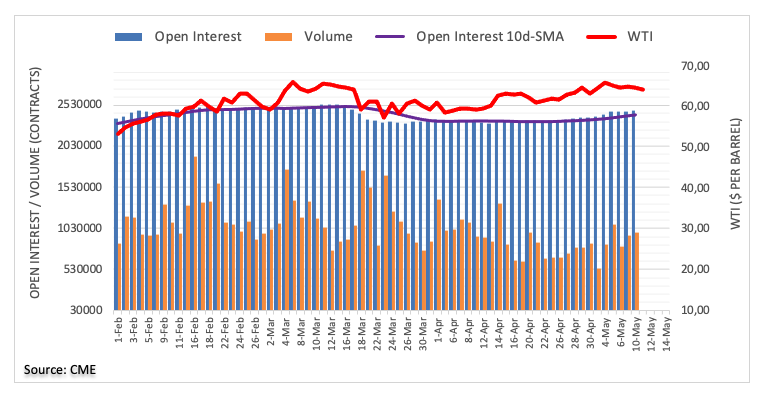

Open interest in Crude Oil futures markets rose by more than 5K contracts on Monday according to preliminary readings from CME Group. Volume followed suit and went up for the second session in a row, this time by around 34.8K contracts.

Prices of the WTI charted an inconclusive session on Monday amidst rising open interest and volume. That said, extra rangebound looks likely in the very near-term, while a surpass of recent peaks near the $65.00 mark per barrel (May 5) could allow for the continuation of the uptrend.