Our best spreads and conditions

About platform

About platform

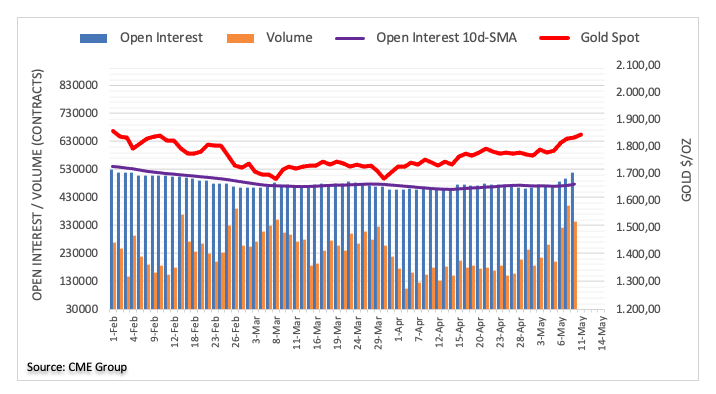

Traders increased their open interest positions for the third session in a row on Monday, this time by around 22.5K contracts, the largest single day build so far this year considering flash data from CME Group. Volume, instead, reversed two straight builds and shrunk by around 58.6K contracts.

Gold prices edged higher at the beginning of the week amidst rising open interest, which is indicative that further upside still has legs to go. Against this, the next significant target lines up at the 200-day SMA around $1,850 per ounce troy.