Gold Price Analysis: XAU/USD closes in on key Fibo resistance above $1,780

- Gold pushes higher after closing in the negative territory last week.

- A break above $1,783 could open the door for additional gains.

- Initial support for XAU/USD is located at $1,775.

The XAU/USD pair suffered heavy losses on surging US Treasury bond yields last Thursday and closed the week in the negative territory. With the greenback struggling to find demand on Monday, the pair turned north and was last seen gaining 0.45% on a daily basis at $1,780.

Later in the session, the IHS Markit and the ISM will be both publishing the US Manufacturing PMI reports for April. Additionally, FOMC Chairman Jerome Powell will be delivering a speech at 1820 GMT.

Gold technical outlook

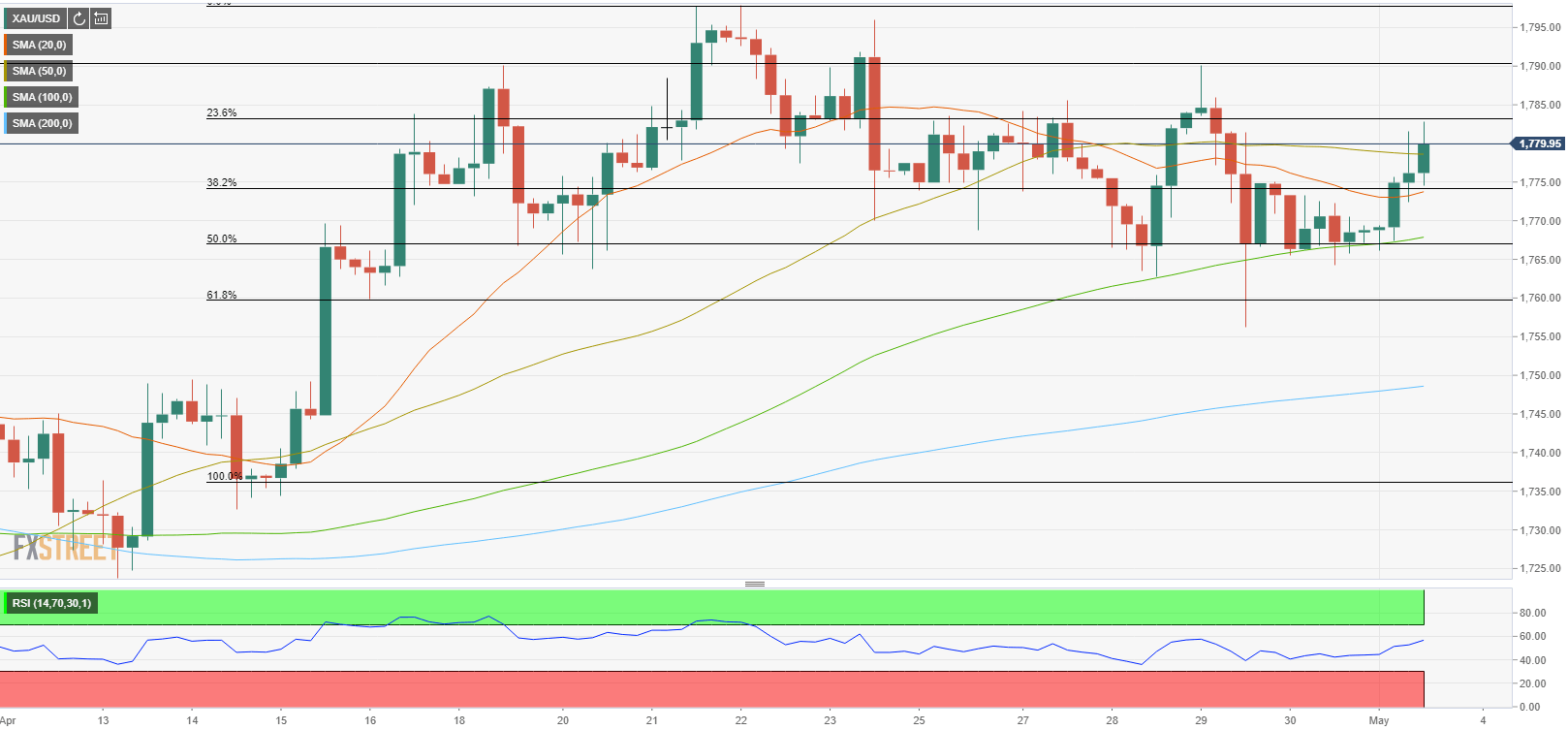

On the four-hour chart, the Relative Strength Index (RSI) indicator is rising toward 60, suggesting that XAU/USD has more room on the upside before becoming technically oversold.

$1,783 (Fibonacci 23.6% retracement of the latest uptrend) aligs as the initial hurdle ahead of $1,790 (static resistance and $1,800 (psychological level). Supports, on the other hand, are located at $1,775 (Fibonacci 38.2% retracement/20-period SMA), $1,767 (100-period SMA/Fibonacci 50% retracement) and $1,760 (Fibonacci 61.8% retracement).

Additional levels to watch for