Back

3 May 2021

NZD/USD Price Analysis: Daily resistance is compelling

- The bulls are seeking a retest of the old support on the daily chart.

- A weekly reverse head and shoulders could be in the making.

NZD/USD is on course for an upside continuation according to the following analysis on the weekly and daily time frames.

The bulls will be seeking a break of the daily resistance which could come of a firm retracement in the coming session.

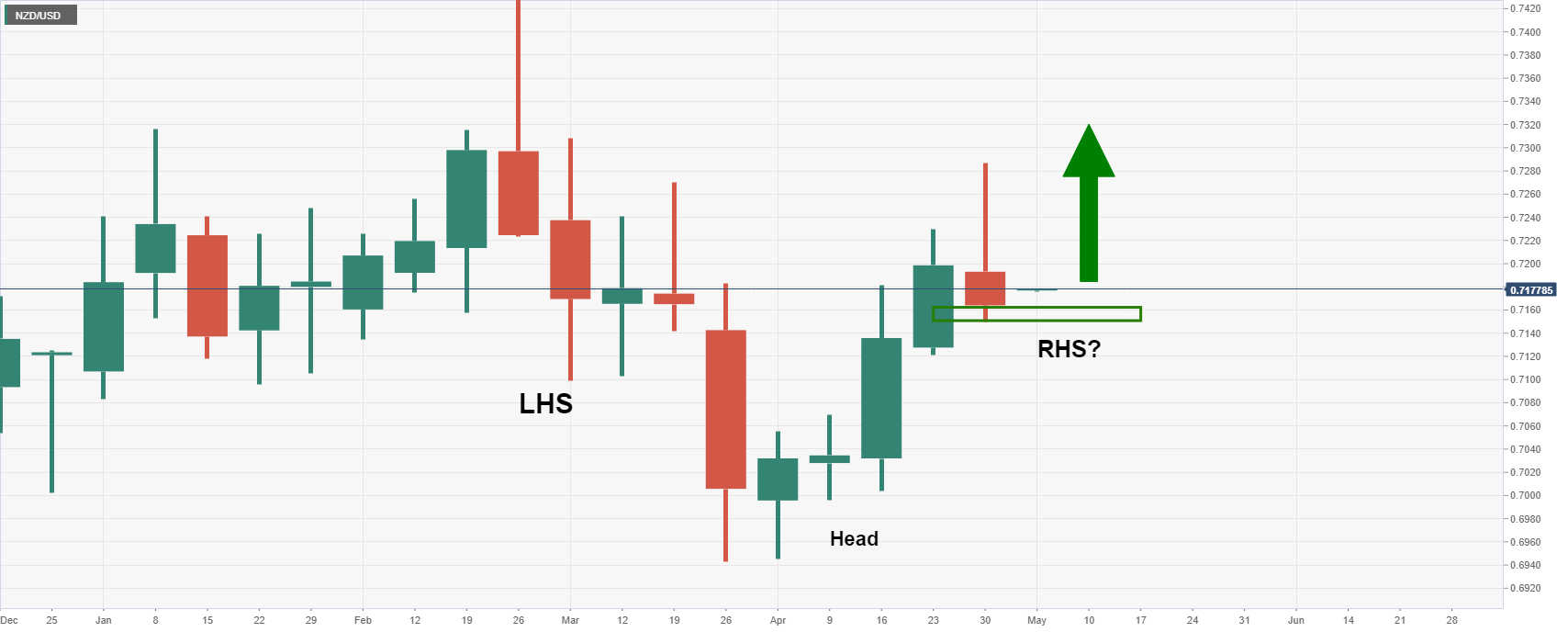

Weekly chart

The right-hand shoulder of the potential bullish reverse head and shoulders could be playing out.

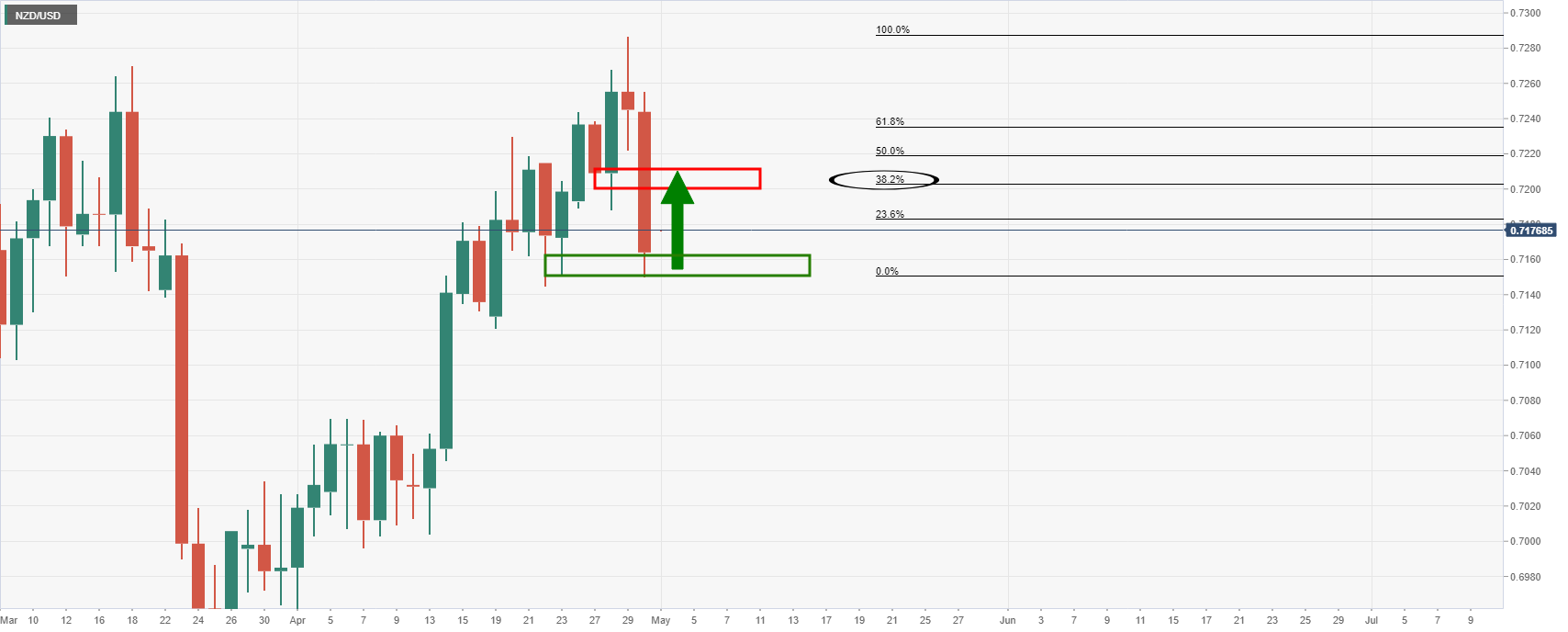

Daily chart

The daily chart shows an M-formation that ties in with the bullish upside bias from a weekly perspective for the immediate session ahead.