Our best spreads and conditions

About platform

About platform

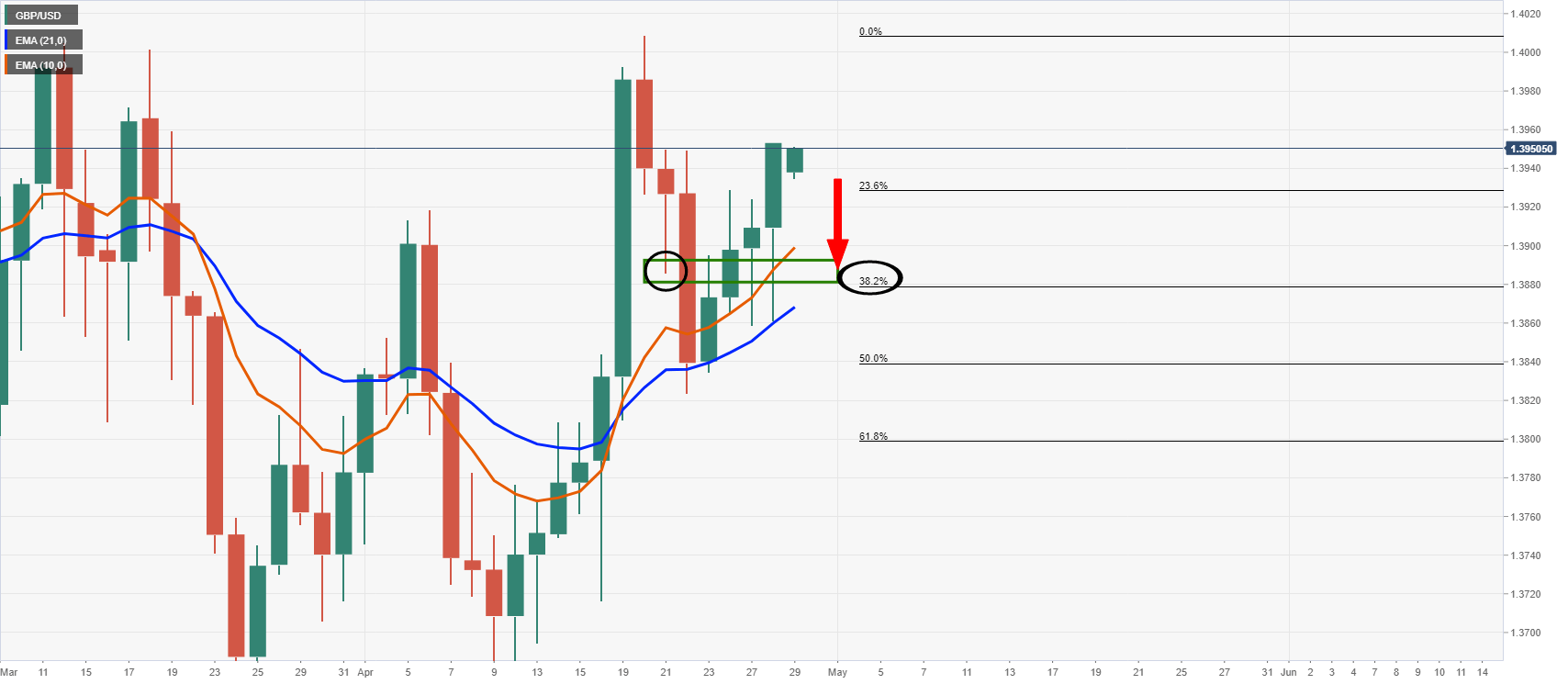

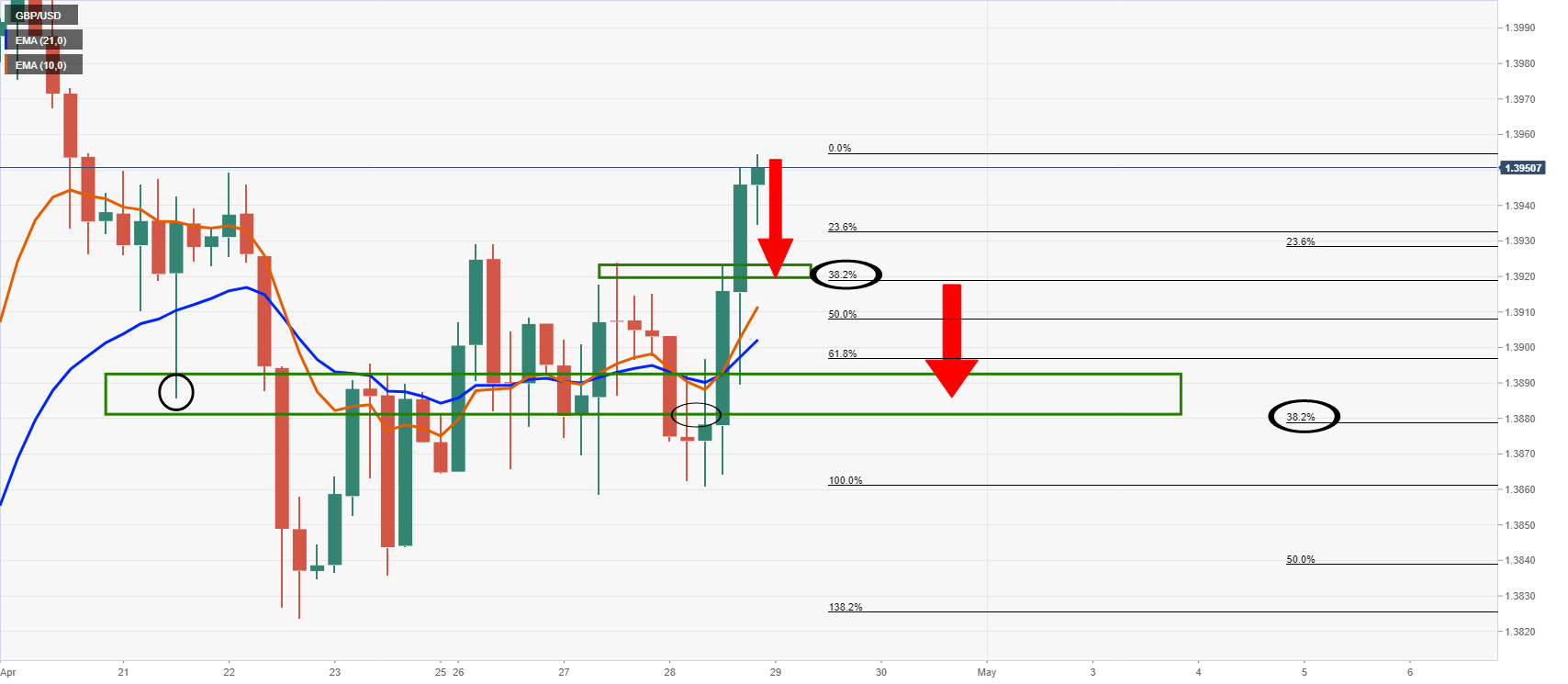

GBP/USD shot higher following the Federal Reserve on Wednesday with the dollar printing fresh cycle lows vs a basket of currencies.

The DXY index hit 90.5530.

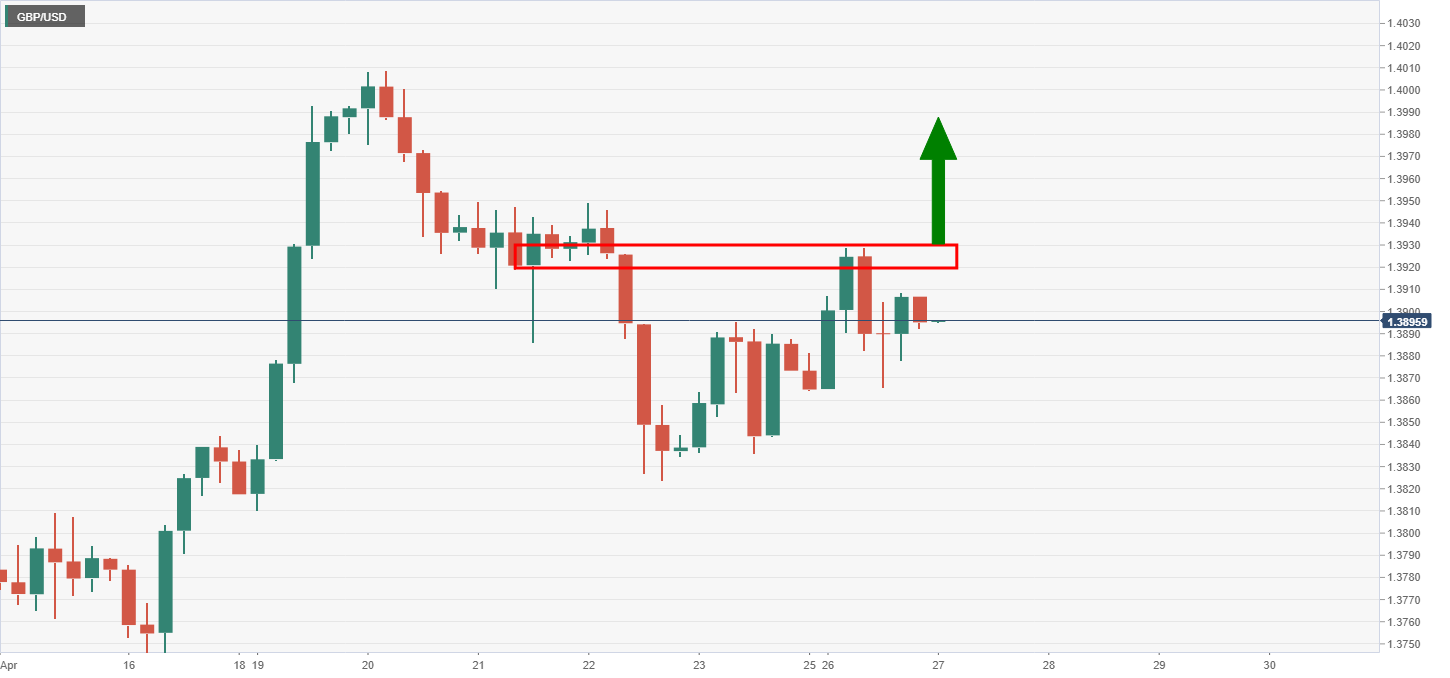

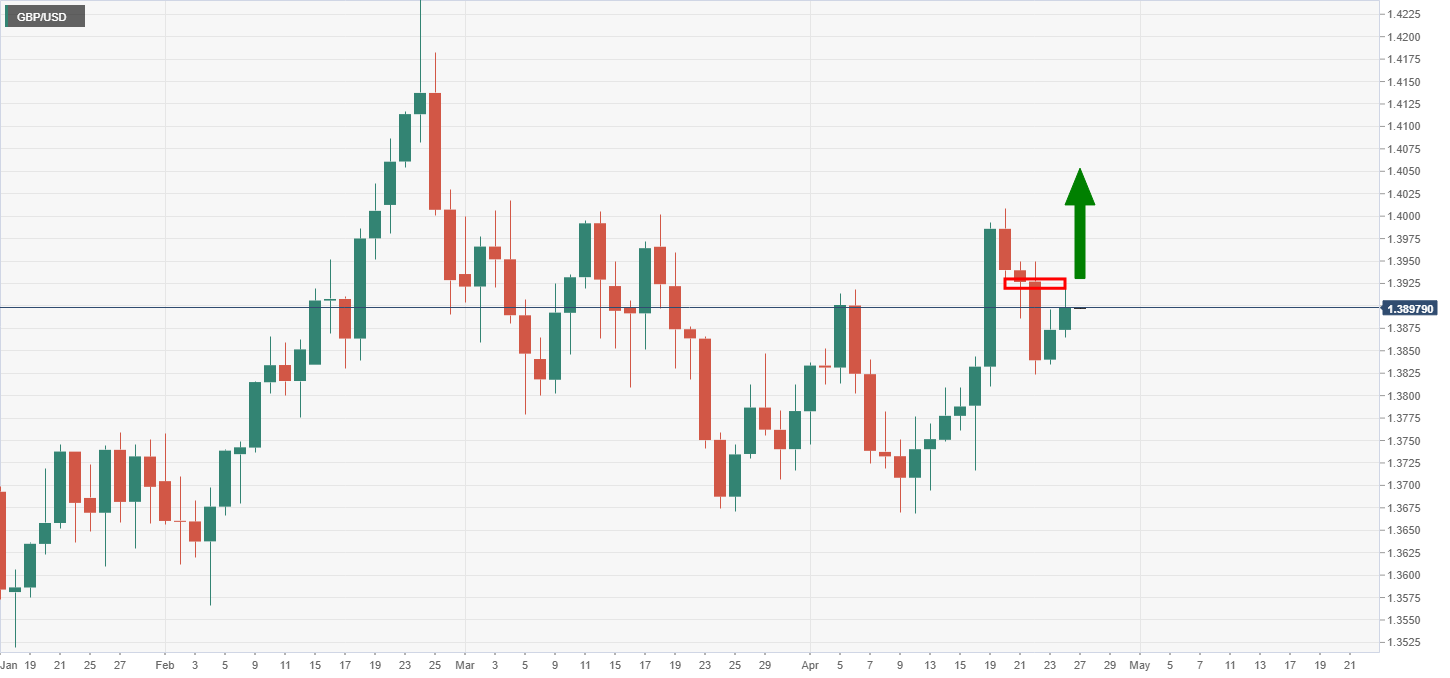

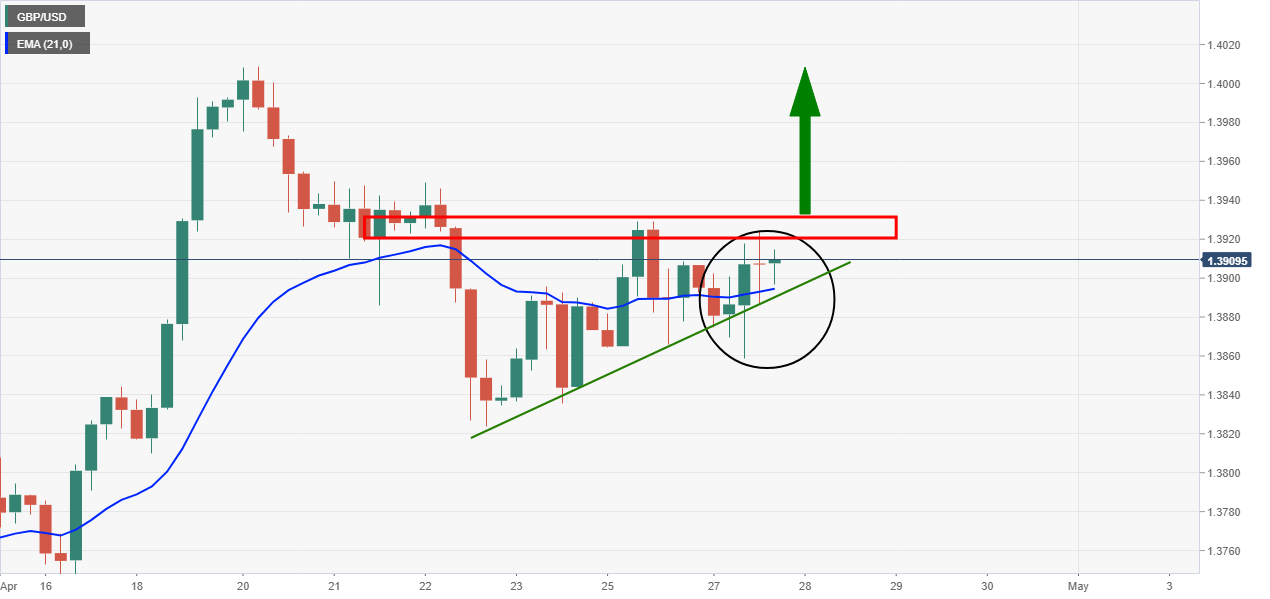

As per the prior analysis, GBP/USD Price Analysis: All eyes on 4-hour resistance, cable is on the verge of a daily continuation following a correction of the prior daily bullish impulse.

However, if the entry opportunity was missed, bulls that were late to the opportunity would be prudent to wait for a discount which is a high probability given the market structure on both the daily and 40hour time frames as follows:

''...if the price breaks 4-hour resistance then the bulls will be in play for a daily upside continuation:''