Our best spreads and conditions

About platform

About platform

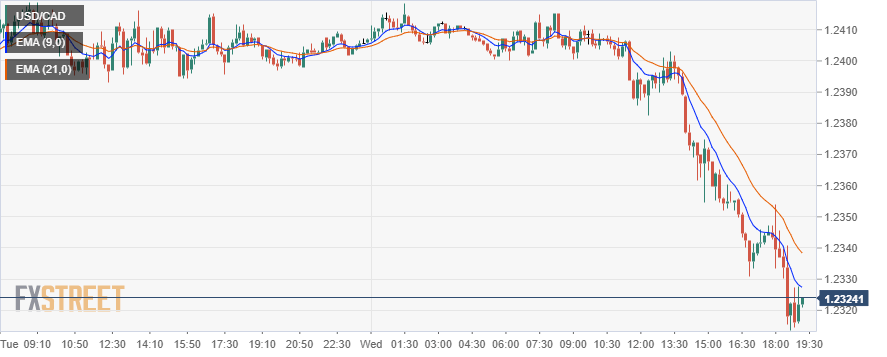

The dollar suffered a post-Fed hangover on Wednesday as Jerome Powell fulfilled his prime duty of calming investor fears over inflation. Powell remained confident throughout despite repeated questioning during the press conference on inflation, house price pressures, and a repeat of the 1960's and 1970's inflationary problems.

Goldman Sachs helped the Canadian dollar on Wednesday as the investment bank predicts the biggest jump in oil demand ever as the global economy rebounds. Goldman predicts the West Texas Intermediate benchmark for oil to hit $80 a barrel by the third quarter of 2021. Remember the price actually went negative during the height of the coronavirus pandemic!

The Canadian dollar is strongly linked to commodity and oil prices as Canada is a leading oil exporter. The CAD had been benefitting even before Wednesday's Fed decision.

Post the decision the Fed took multiple opportunities to reassert its doveish stance. Inflation is not a problem going forward according to the Fed. No amount of probing or questioning during the press conference could shake Chairman Powell's view that inflation may rise above 2% in the short term but is not going to be a long-term problem. The focus is firmly on employment growth and maintaining economic supports.

This doveish tone sent US yields lower with the US 10 Year yield now hitting 1.61%. The dollar suffered across the board falling below 1.21 versus the Euro. CAD was boosted from general dollar weakness and oil prices continuing to be supported near $64. 1.23 is the near-term round number target with $1.2247 the next target being the low from January 2018.

-637552343883615795.png)

| OVERVIEW | |

|---|---|

| Today last price | 1.233 |

| Today Daily Change | -0.0059 |

| Today Daily Change % | -0.48 |

| Today daily open | 1.2399 |

| LEVELS | |

|---|---|

| Previous Daily High | 1.2419 |

| Previous Daily Low | 1.2389 |

| Previous Weekly High | 1.2654 |

| Previous Weekly Low | 1.246 |

| Previous Monthly High | 1.274 |

| Previous Monthly Low | 1.2365 |

| Daily Fibonacci 38.2% | 1.2407 |

| Daily Fibonacci 61.8% | 1.24 |

| Daily Pivot Point S1 | 1.2385 |

| Daily Pivot Point S2 | 1.2372 |

| Daily Pivot Point S3 | 1.2355 |

| Daily Pivot Point R1 | 1.2415 |

| Daily Pivot Point R2 | 1.2432 |

| Daily Pivot Point R3 | 1.2445 |