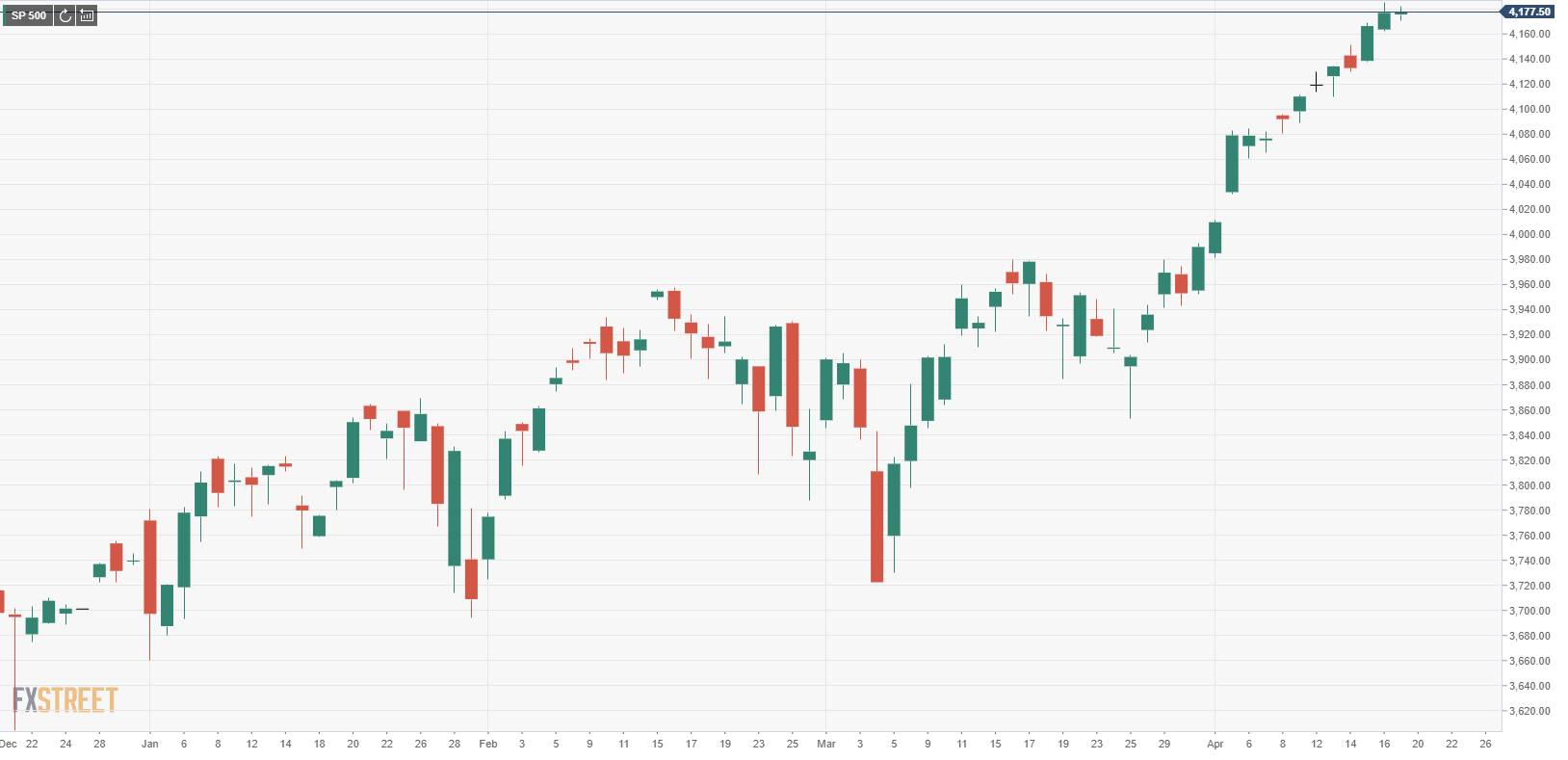

S&P 500 Index opens modestly lower following last week's upsurge

- Wall Street's main indexes started the new week modestly lower.

- Energy shares post modest gains on the back of rising crude oil prices.

Following last week's impressive rally, major equity indexes in the US opened modestly lower on Monday as investors seem to be staying on the sidelines while waiting for the next significant catalyst. As of writing, the S&P 500 Index was down 0.15% on the day at 4,179, the Dow Jones Industrial Average was losing 0.3% at 34,102 and the Nasdaq Composite was falling 0.25% at 14,003.

Among the 11 major S&P 500 sectors, the Energy Index is up 0.45% as the top gainer after the opening bell supported by a 0.6% increase in US crude oil prices. On the other hand, the Utilities Index is losing 0.65%.

In the meantime, US Treasury bond yields are staging a rebound on Monday, forcing investors to adopt a cautious tone. At the moment, the benchmark 10-year US T-bond yield is rising nearly 2% on the day at 1.61% and Wall Street's main indexes could struggle to gain traction if yields continue to push higher.

S&P 500 chart (daily)