GBP/USD Price Analysis: Hits one-month tops, 1.4000 mark is the next stop for bulls

- GBP/USD continued scaling higher for the sixth straight session amid sustained USD selling.

- The stage now seems set for a move towards March swing highs, around the 1.4000 mark.

- Slightly overbought RSI on hourly charts warrants caution before placing aggressive bets.

The GBP/USD pair gained strong follow-through traction for the sixth consecutive day on Monday and jumped to one-month tops, around the 1.3925 region during the mid-European session.

The bearish pressure surrounding the US dollar remained unabated amid expectations that the Fed will keep interest rates lower for a longer period. This, in turn, was seen as a key factor that allowed the GBP/USD pair to build on last week's solid rebound from 100-day SMA support, near the 1.3670 area.

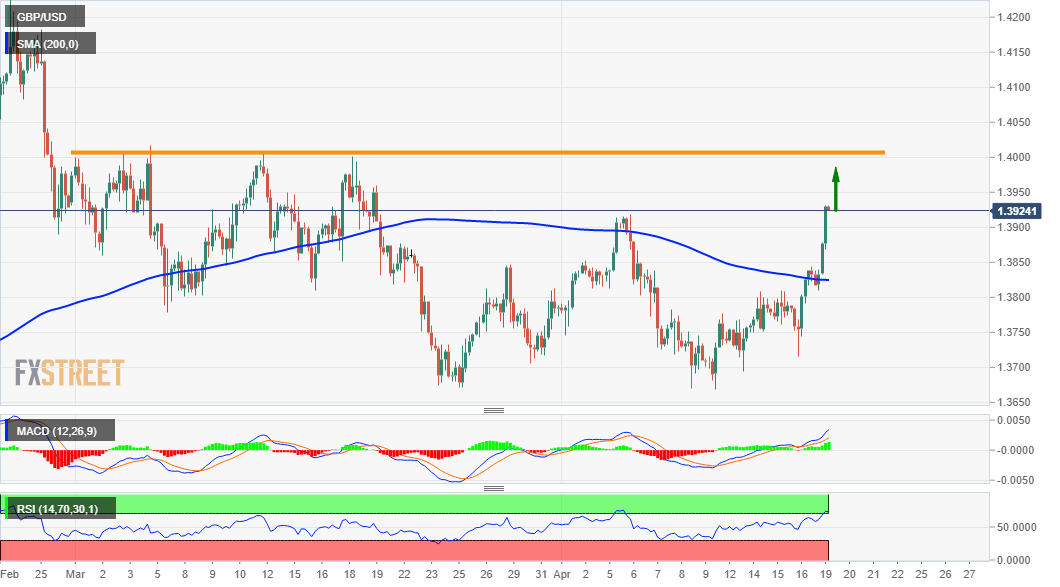

Looking at the technical picture, a decisive breakthrough a one-month-old descending trend-line and the 1.3900 mark was seen as a key trigger for intraday bullish traders. A subsequent strength beyond the monthly swing highs, around the 1.3920 region might have set the stage for additional gains.

The constructive set-up is reinforced by the fact that technical indicators on the daily chart have just started moving into the positive territory. That said, RSI (14) on hourly charts is already flashing slightly overbought conditions and warrants some caution for aggressive bullish traders.

Nevertheless, the price action suggests that the path of least resistance for the GBP/USD pair is to the upside. Hence, a move back towards reclaiming the key 1.4000 psychological mark, which coincides with March monthly swing highs, looks a distinct possibility amid an empty US economic docket.

On the flip side, the 1.3900 mark now seems to act as immediate strong support. Any further weakness might now be seen as a buying opportunity. This, in turn, should help limit the downside near a support marked by the 200-period SMA on the 4-hourly chart, around the 1.3830-25 region.

GBP/USD 4-hour chart

Technical levels to watch