GBP/USD Price Analysis: Bears challenge two-week-old trend-line support near 1.3770

- GBP/USD added to the overnight losses and lost some additional ground on Wednesday.

- The intraday decline, for now, found some support near a short-term ascending trend-line.

- The set-up favours bearish traders and supports prospects for a slide to the 1.3700 mark.

The GBP/USD pair extended the previous day's sharp retracement slide from over two-week tops and witnessed some follow-through selling for the second consecutive session on Wednesday.

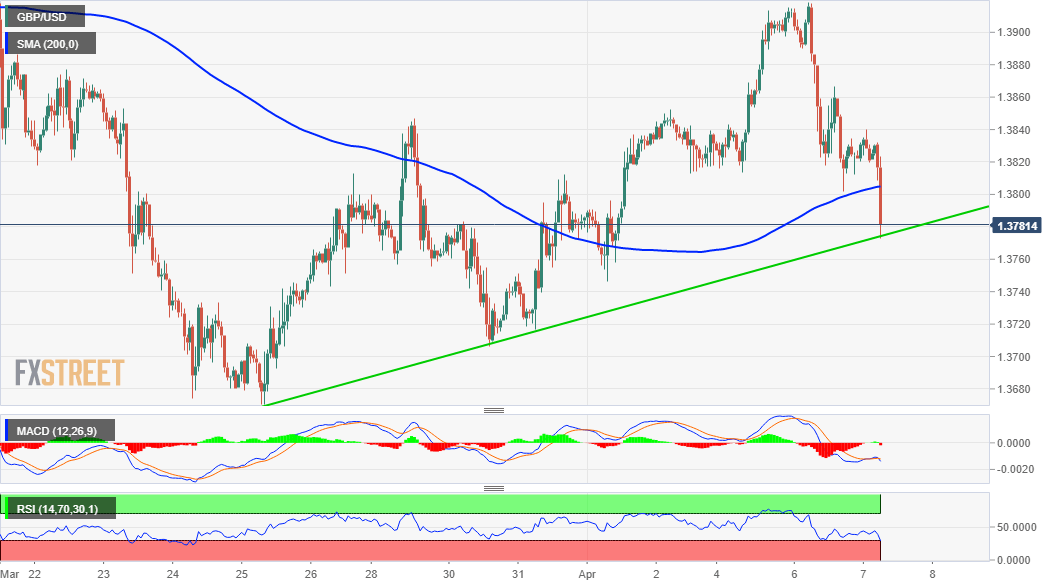

A sustained break below the 1.3800 mark, which coincided with the 200-hour SMA, was seen as a key trigger for intraday bearish traders. The downward momentum dragged the GBP/USD pair to four-day lows, around the 1.3770 region, which marks a near two-week-old ascending trend-line support.

Meanwhile, technical indicators on hourly charts have been gaining negative momentum and just started entering the bearish territory on the daily chart. The set-up supports prospects for an extension of the ongoing bearish trend amid a modest pickup in the US dollar demand.

A convincing break below the ascending trend-line support will reaffirm the bearish bias and turn the GBP/USD pair vulnerable to fall further towards the 1.3700 mark. Some follow-through selling should pave the way for a slide to retest multi-week lows, around the 1.3670 region.

On the flip side, any meaningful recovery back above the 1.3800 mark might now be seen as an opportunity to initiate fresh bearish positions. This, in turn, should cap the GBP/USD pair near the 1.3840 region, or intraday swing highs touched earlier during the Asian session.

GBP/USD 1-hour chart

Technical levels to watch