Our best spreads and conditions

About platform

About platform

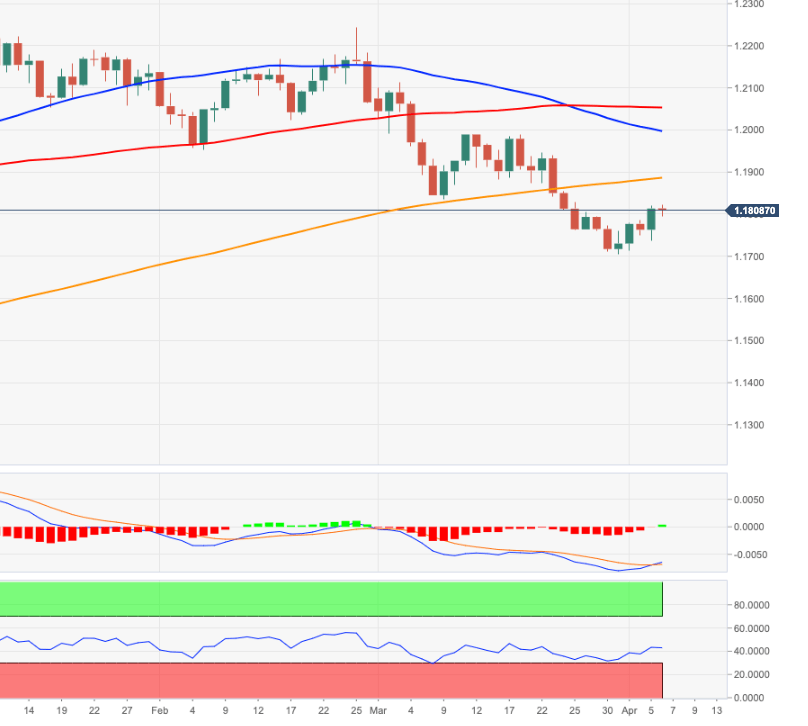

EUR/US’s upside momentum seems to have faltered around the 1.1820/25 band on Tuesday.

In spite of the bounce seen at the beginning of the week, it seems sellers remain in control of the price action, leaving the pair vulnerable to another bearish move in the near-term.

However, a convincing surpass of 1.1875 could see gains accelerate to the next hurdle of relevance in the 1.1980/90 band.

While below the 200-day SMA (1.1875) the short-term stance for EUR/USD is expected to remain negative.