Our best spreads and conditions

About platform

About platform

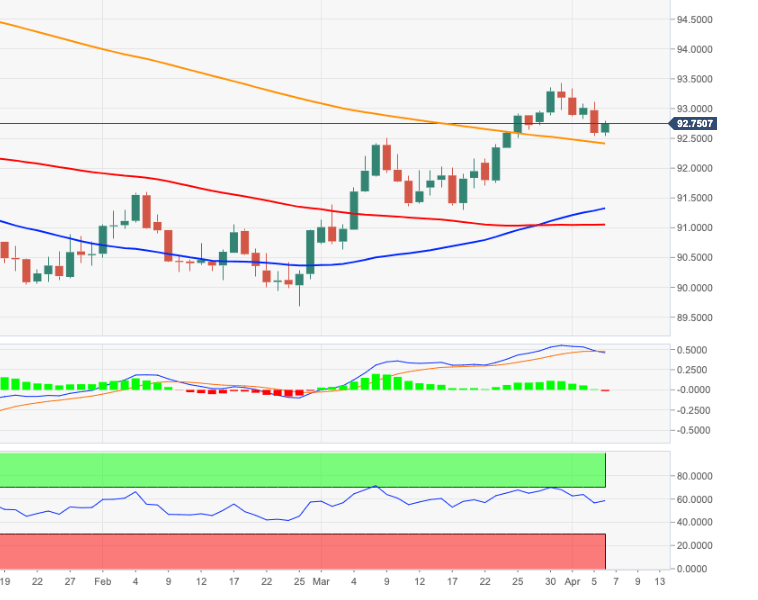

Monday’s downtick in the dollar halted just ahead of the critical 200-day SMA in the 92.40 region.

While above this area, the near-term outlook for DXY is expected to remain constructive and allow for extra gains.

On the opposite side, a convincing return to the area below the 200-day SMA should negate the ongoing near-term positive stance and open the door to fresh weakness to, initially, 91.30 (March 18).