Back

6 Apr 2021

EUR/JPY Price Analysis: Next on the upside comes in the 2021 highs

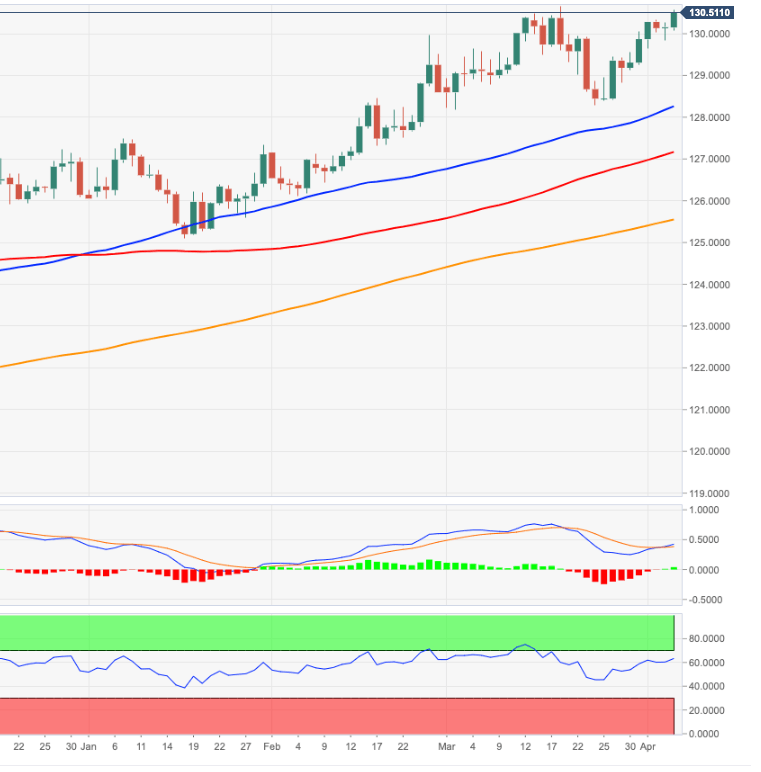

- EUR/JPY moves further north of the 130.00 yardstick.

- The 2021 tops in the 130.65/70 band emerge as the next hurdle.

EUR/JPY reverses the recent weakness and manages to push higher beyond the key barrier at 130.00 the figure.

The recovery remains healthy and an attempt to test the 2021 high at 130.66 (March 18) looks increasingly likely in the near-term. While above the short-term support line in the 128.30 region, extra gains remain well on the table. This area of contention is reinforced by the proximity of the 50-day SMA at 128.46.

A break below the latter should alleviate the upside pressure and allow for some corrective downside in the short-term view.

In the meantime, while above the 200-day SMA at 125.46 the broader outlook for the cross should remain constructive.

EUR/JPY daily chart