Back

17 Mar 2021

Analisis Harga Indeks Dolar AS: Tetap Berhati-Hati Jelang FOMC

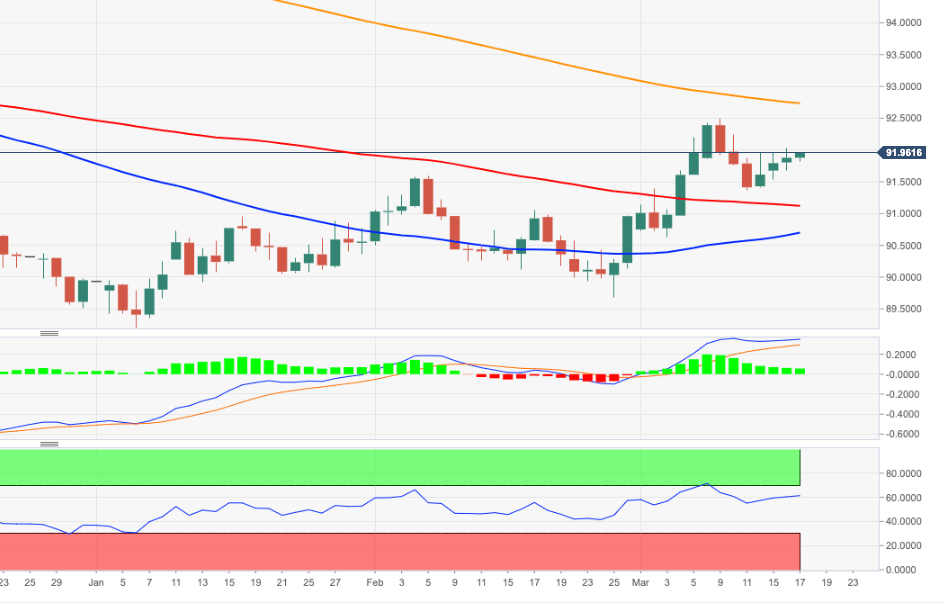

- DXY memperpanjang kenaikan bertahapnya meskipun masih di bawah 92,00.

- Target berikutnya di puncak tahun di sekitar 92,50.

Pemulihan DXY masih tetap tidak dapat menyerang dan melampaui rintangan utama di lingkungan 92,00.

Kenaikan ekstra dalam dolar tetap mungkin terjadi, meskipun acara FOMC Rabu ini diperkirakan menjadi penting untuk aspirasi pembeli. Jika dorongan ke atas mengumpulkan tenaga ekstra, maka DXY diperkirakan akan kembali fokus pada puncak tahunan sejauh ini di 92,50an di depan SMA 200-hari yang kritis, hari ini di 92,73.

Penembusan di atas 92,73 akan mengubah prospek menjadi konstruktif (dari bearish) dan memungkinkan kenaikan lebih lanjut dalam horizon jangka pendek.

Grafik harian DXY