Our best spreads and conditions

About platform

About platform

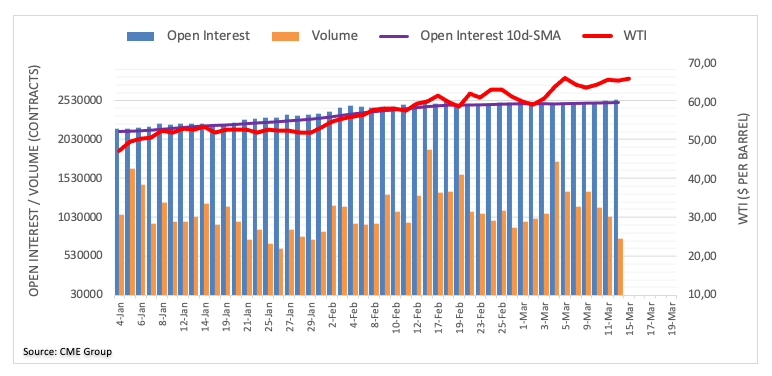

CME Group’s advanced prints for crude oil futures markets noted traders added around 8.8K contracts to their open interest positions on Friday, reaching the third build in a row. Volume, instead, went down for the third straight session, this time by around 273.5K contracts.

Friday’s inconclusive session gyrated around the $66.00 neighbourhood amidst rising open interest, leaving the door open for the continuation of this mood at least in the very near-term. In the meantime, prices of the WTI face the next relevant resistance at the 2021 highs just below the $68.00 mark per barrel (March 8).