Back

15 Mar 2021

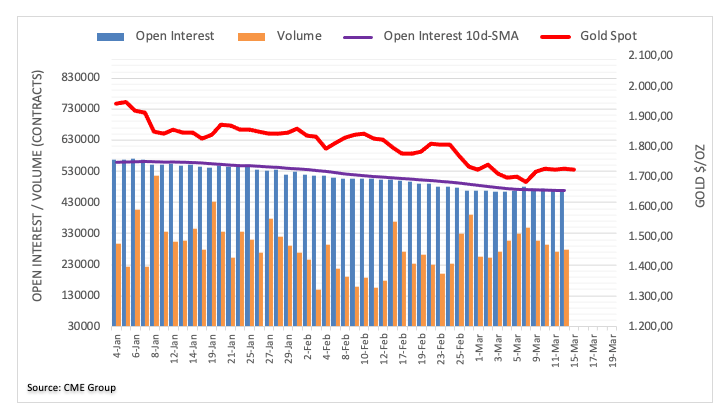

Gold Futures: Upside looks limited

Open interest in Gold futures markets shrunk for the second session in a row on Friday, this time by around 1.3K contracts according to preliminary figures from CME Group. On the other hand, volume reversed three pullbacks in a row and went up by nearly 5.2K contracts.

Gold remains supported around $1,680/oz

Friday’s test and rebound from the $1,700 neighbourhood was amidst shrinking open interest and small gains in the precious metal. That said, while gold faces decent contention in the $1,680 area per ounce, the upside appears somewhat contained in the very near-term.