USD/CAD Outlook: Bears take a brief pause as the focus now shifts to FOMC meeting

- USD/CAD now seems to have entered a bearish consolidation phase near three-year lows.

- Friday’s stellar Canadian jobs report, bullish oil prices continued underpinning the loonie.

- The upbeat US economic outlook extended some support to the USD and helped limit losses.

The USD/CAD pair was seen oscillating in a narrow trading band through the Asian session on Monday and consolidating its recent losses to over three-year lows. The commodity-linked loonie remained well supported by the prevalent bullish sentiment surrounding crude oil prices and got an additional boost from Friday's blockbuster Canadian employment details. Statistics Canada reported that the Canadian economy added 259.2K jobs in February, surpassing market expectations by a big margin. This marked the first month of gains in the previous three and was accompanied by a slump in the unemployment rate to 8.2% from 9.4% previous.

Meanwhile, oil prices continued benefitting from an extension of output cuts from major producers and improving the global fuel demand outlook. The negative factors, to some extent, were offset by growing optimism over a relatively faster US economic recovery, which extended some support to the US dollar. The impressive pace of COVID-19 vaccinations and the passage of a massive $1.9 trillion US stimulus package remained supportive of the upbeat US economic outlook. Apart from this, the recent runaway rally in the US Treasury bond yields further underpinned the greenback and helped limit any further losses for the major.

Investors also seemed reluctant to place any aggressive bets amid extremely oversold conditions on short-term charts and ahead of the FOMC monetary policy meeting this week. The highly-anticipated Fed decision will influence the US bond yields and play a key role in driving the USD in the near-term. This, in turn, will provide a meaningful impetus and assist traders to determine the next leg of a directional move for the pair. In the meantime, a relatively lighter economic docket on Monday – featuring the only release of the Empire State Manufacturing Index – might hold traders on the sidelines and lead to a subdued/range-bound price action.

Short-term technical outlook

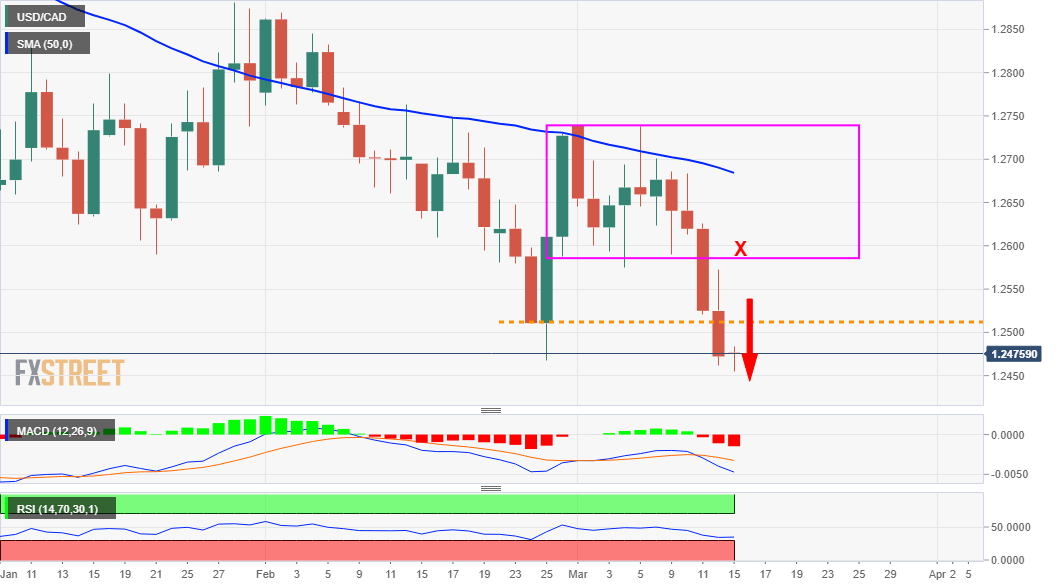

From a technical perspective, last week’s sustained break through a short-term trading range confirmed a near-term bearish breakdown. A subsequent fall below the key 1.2500 psychological mark might have already set the stage for an extension of the recent/well-established downward trajectory. Hence, attempted recovery back towards the mentioned handle might be seen as a selling opportunity. That said, some follow-through buying has the potential to lift the pair back towards the trading range support breakpoint, now turned resistance near the 1.2570-75 region. This is followed by the 1.2600 round-figure mark, 1.2630 horizontal resistance and 50-day SMA near the 1.2680-85 region. Only a sustained strength beyond the mentioned hurdles will negate the near-term bearish bias and pave the way for some meaningful upside for the major.

On the flip side, multi-year lows, around the 1.2455 region touched earlier this Monday, now seems to protect the immediate downside. Failure to defend the mentioned area should pave the way for an extension of the bearish trend and accelerate the decline towards the 1.2400 round-figure mark. Bears might then drag the pair further towards the 1.2300 mark before eventually aiming to challenge 2018 yearly lows, around mid-1.2200s.