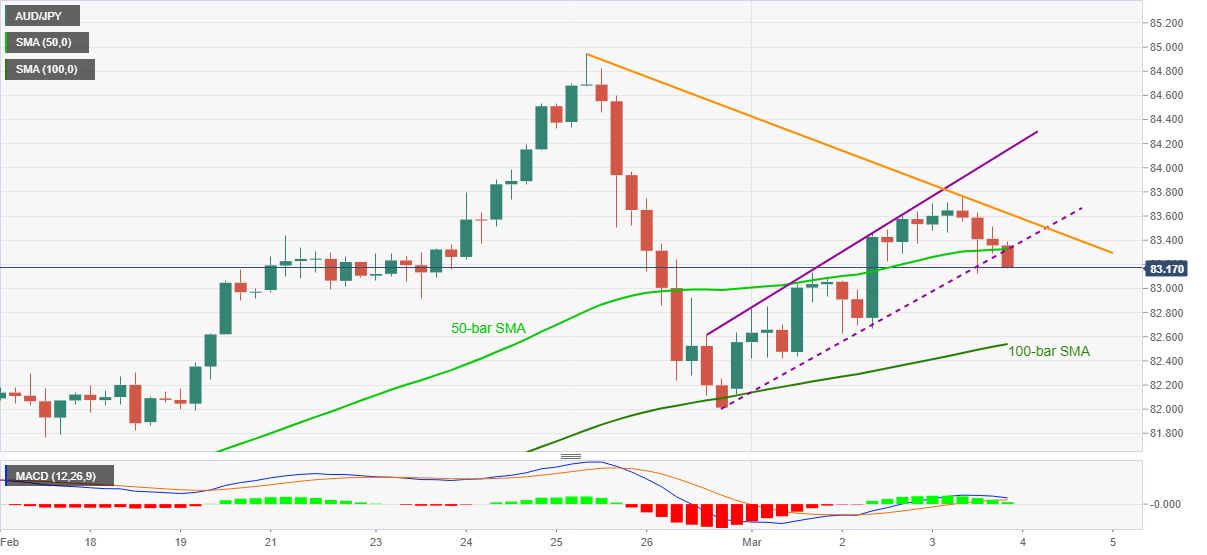

AUD/JPY Price Analysis: Drops towards 83.00 on breaking one-week-old support

- AUD/JPY takes offers after breaking 50-bar SMA, one-week-old ascending trend channel.

- MACD also teases bears, 100-bar SMA lures short-term sellers.

- Short-term falling trend line adds to the upside barriers.

AUD/JPY extends the previous day’s losses while declining to 83.17 during the early Asian session on Thursday. In doing so, the pair reacts to the latest breakdown of an ascending trend channel formation since February 26 as well as 50-bar SMA.

Given the MACD conditions teasing the AUD/JPY sellers, the quote is likely eyeing the 100-bar SMA level of 82.54. However, the 83.00 threshold will offer an intermediate halt during the fall.

Should the AUD/JPY bears refrain to step back from 100-bar SMA, like they did last week, Friday’s low near 81.99 becomes the key.

Meanwhile, a corrective pullback beyond the previous support confluence near 83.35 will need to cross a one-week-old descending trend line resistance, at 83.65, to recall the AUD/JPY buyers.

Following that, the stated channel’s upper line around 84.15 and February’s top near 85.00 should gain the market’s attention.

AUD/JPY four-hour chart

Trend: Further downside expected