Back

12 Feb 2021

Crude Oil Futures: Scope for further correction

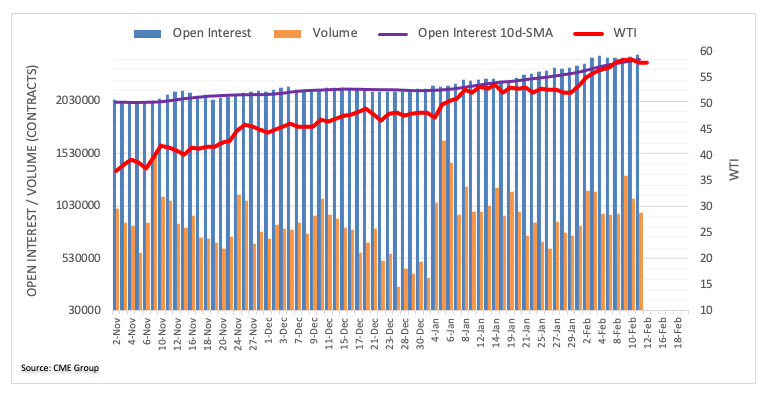

CME Group’s flash prints for crude oil futures markets noted open interest increased for the third consecutive session on Thursday, now by more than 20K contracts. Volume, instead, shrunk for the second straight session, this time by around 134.2K contracts.

WTI still eyes the $60.00 mark

Prices of the West Texas Intermediate navigate a corrective downside following recent tops beyond the $58.00 mark. Rising open interest on Thursday allows for the continuation of the leg lower in the very near-term, although the sharp contraction of volume could remove some steam from the probable retracement. On the upside, all the attention remains on the psychological $60 mark per barrel of WTI.