EUR/GBP Price Analysis: Struggles to regain traction above 0.8800

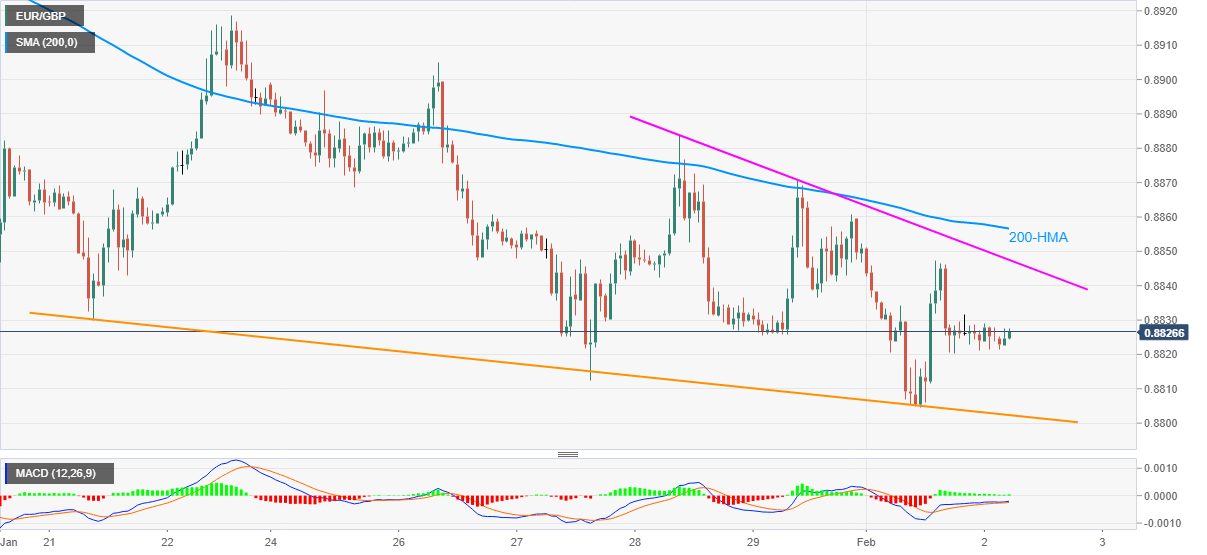

- EUR/GBP wavers in a choppy range between 0.8820 and 0.8830.

- Bulls eye three-day-old resistance line, 200-HMA amid no negative MACD.

- Two-week-old support line raise bars for sellers’ entry.

EUR/GBP picks up bids near 0.8827 ahead of Tuesday’s European session. In doing so, buyers attack the upper end of an immediate trading range while keeping the previous day’s bounce off fresh low since May 2020.

Considering the quote’s sustained trading beyond the key support line, stretched from January 21, coupled with an absence of bearish MACD, favor EUR/GBP bulls to eye a falling resistance line from Thursday, at 0.8847 now.

However, any further upside past-0.8847 will have to cross the 200-HMA level of 0.8856 before confirming the rise towards the 0.8900 threshold.

Meanwhile, 0.8820 offers immediate support to the quote before the aforementioned descending support line probes EUR/GBP sellers around the 0.8800 psychological magnet.

In a case where the quote remains depressed below 0.8800, odds of its gradual south-run targeting April 2020 low near 0.8670 can’t be ruled out.

EUR/GBP hourly chart

Trend: Corrective pullback expected