S&P 500 Index starts new week sharply higher on stimulus hopes

- Wall Street's main indexes are posting impressive gains on Monday.

- US President Joe Biden will meet with Republican senators to discuss $600 billion COVID relief plan.

- The S&P 500 Technology Index is up nearly 1.5%.

Major equity indexes in the US opened sharply higher on Monday as investors cheer renewed hopes for additional fiscal stimulus in the US. As of writing, the Dow Jones Industrial Average was up 0.75% on the day at 30,203, the S&P 500 Index was up 0.95% at 3,749 and the Nasdaq Composite was gaining 1.25% at 13,087.

Reflecting the upbeat market mood, the CBOE Volatility Index (VIX), Wall Street's fear gauge, is down nearly 5% on the day.

US Republican Senator Susan Collins announced that US President Joe Biden has agreed to meet with 10 Republican senators on Monday to discuss the stimulus package worth around $600 billion.

Among the 11 major S&P 500 sectors, the Consumer Discretionary and the Technology indexes both gain more than 1% as the top performers after the opening bell. On the other hand, the defensive Utilities and Real Estate indexes trade in the negative territory.

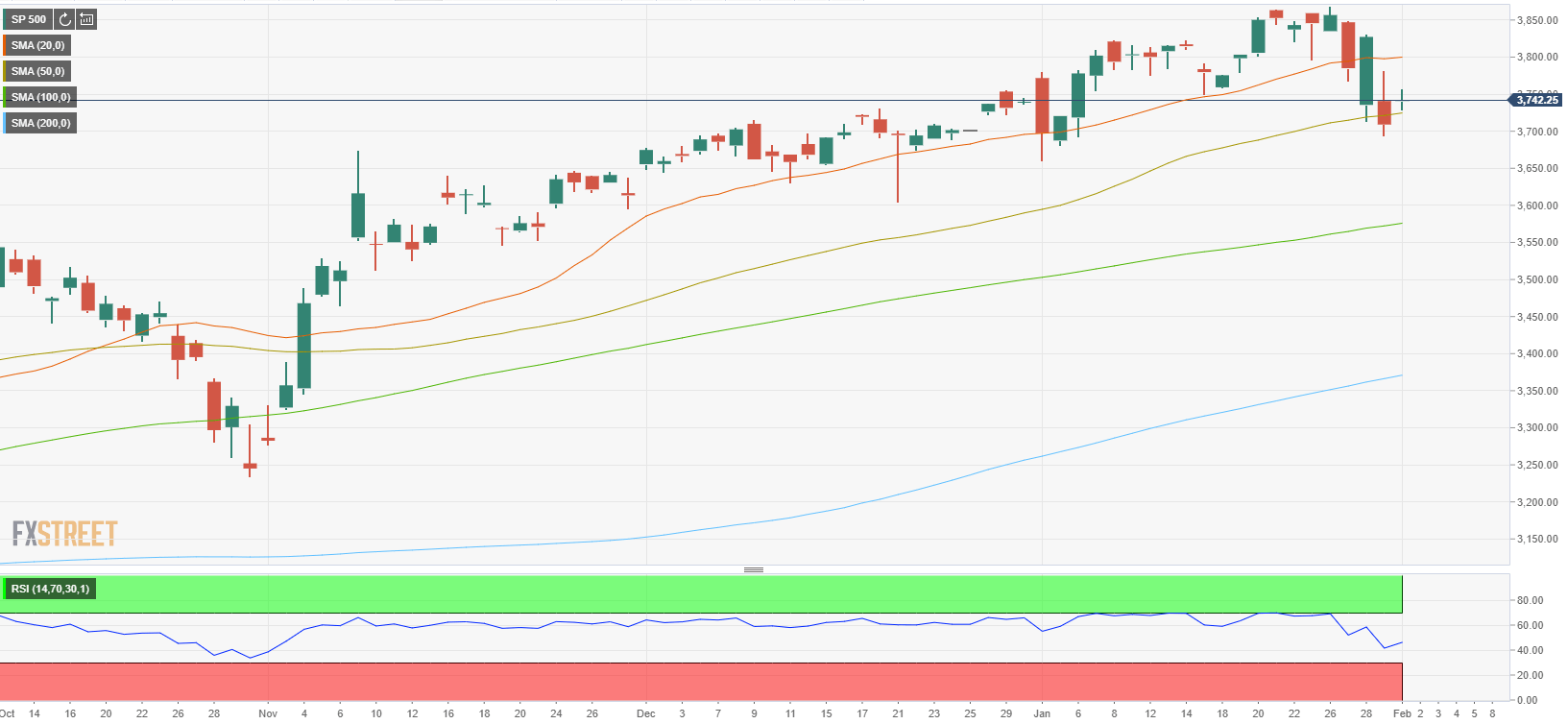

S&P 500 chart (daily)