Our best spreads and conditions

About platform

About platform

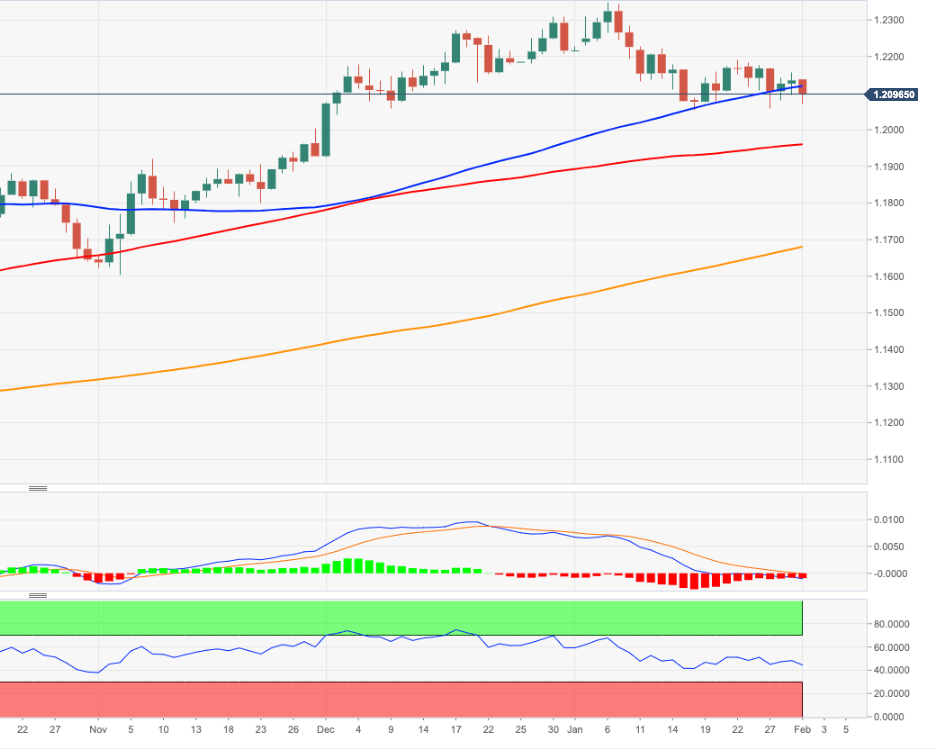

EUR/USD starts the week on the soft side and recedes to the area below the 1.2100 yardstick.

Further decline is expected to meet decent contention in the 1.2050 region, where sits the so far yearly lows (January 18). A deeper pullback carries the potential to challenge the psychological support at 1.20 the figure, although a move further south of this level is not favoured in the short-term horizon. Below 1.2000 is located a Fibo level at 1.1976.

On the broader picture, the constructive stance in EUR/USD remains unchanged while above the critical 200-day SMA, today at 1.1665.

Looking at the monthly chart, the (solid) breakout of the 2008-2020 line is a big bullish event and should underpin the continuation of the current trend in the longer run.