Back

1 Feb 2021

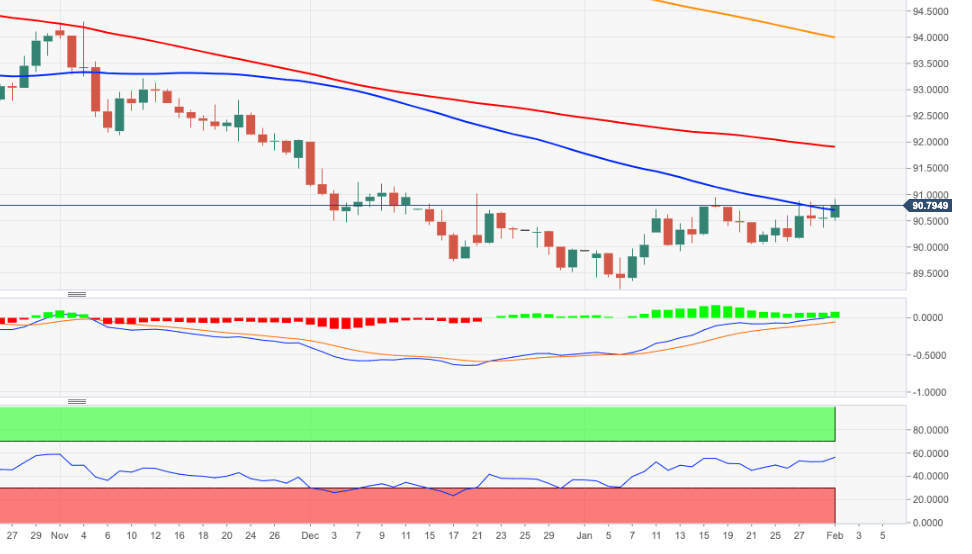

US Dollar Index Price Analysis: Scope for a re-visit to 91.00

- DXY adds to Friday’s gains and approaches the 91.00 level.

- The 2020-2021 resistance line offers resistance around 90.80.

DXY picks up extra pace and trades at shouting distance from the key 91.00 neighbourhood at the beginning of the week.

The 91.00 area emerges as the immediate target of significance. In this are coincide weekly tops (December 21), the so far 2021 high (January 18) and the 2021 resistance line. Above this region, the selling pressure is forecast to mitigate somewhat.

The ongoing rebound is seen as corrective only and in the longer run, as long as DXY trades below the 200-day SMA, today at 93.99 the negative view is expected to persist.

DXY daily chart