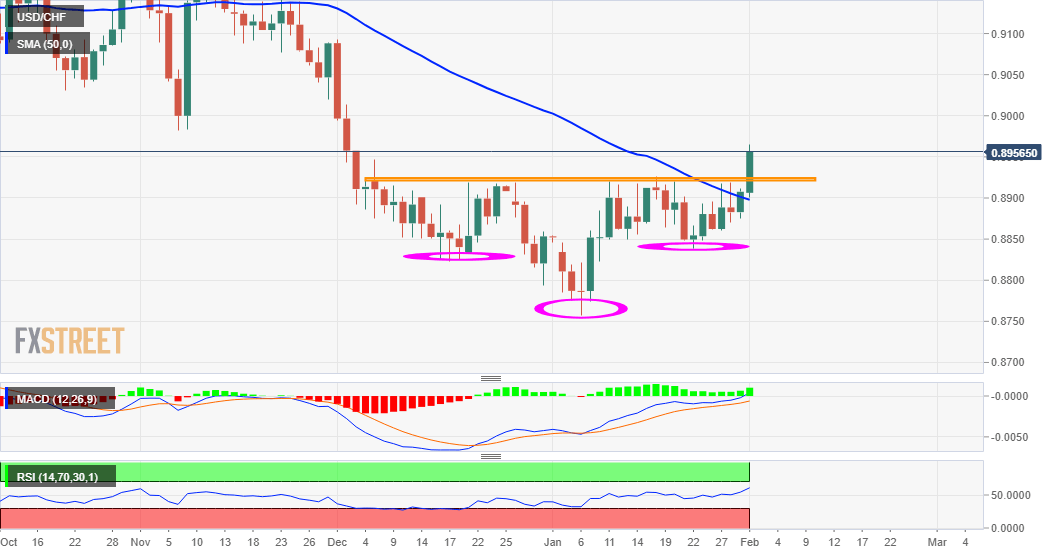

USD/CHF Price Analysis: Bulls remain in control near two-month tops, above mid-0.8900s

- USD/CHF confirmed a near-term bullish breakout through head and shoulders neckline resistance.

- The near-term technical set-up favours bullish traders and supports prospects for additional gains.

- The emergence of some dip-buying should help limit the downside near the 0.8900-0.8890 area.

The USD/CHF pair gained strong positive traction on the first day of a new week and jumped to two-month tops, around the 0.8965 region during the early European session.

A sustained move beyond a strong horizontal barrier, around the 0.8920 region, was seen as a key trigger for bullish traders. The mentioned barrier acted as a neckline resistance of an inverted head and shoulders chart pattern.

Technical indicators on the daily chart are holding comfortably in the bullish territory and are still far from being in the oversold zone. This, in turn, favours bullish traders and supports prospects for additional gains in the near-term.

Hence, a subsequent move beyond the key 0.9000 psychological mark, en-route the 0.9040-50 resistance, now looks a distinct possibility. Some follow-through buying has the potential to push the USD/CHF pair further towards the 0.9075 barrier.

On the flip side, the neckline resistance breakpoint, which coincides with 50-day SMA, now seems to protect the immediate downside. Any further decline might be seen as a buying opportunity and remain limited near the 0.8890 horizontal level.

This is followed by support near the 0.8830 region, which if broken decisively will negate any near-term positive outlook and prompt some aggressive technical selling. The USD/CHF pair might the turn vulnerable to slide back below the 0.8800 mark.

USD/CHF daily chart

Technical levels to watch