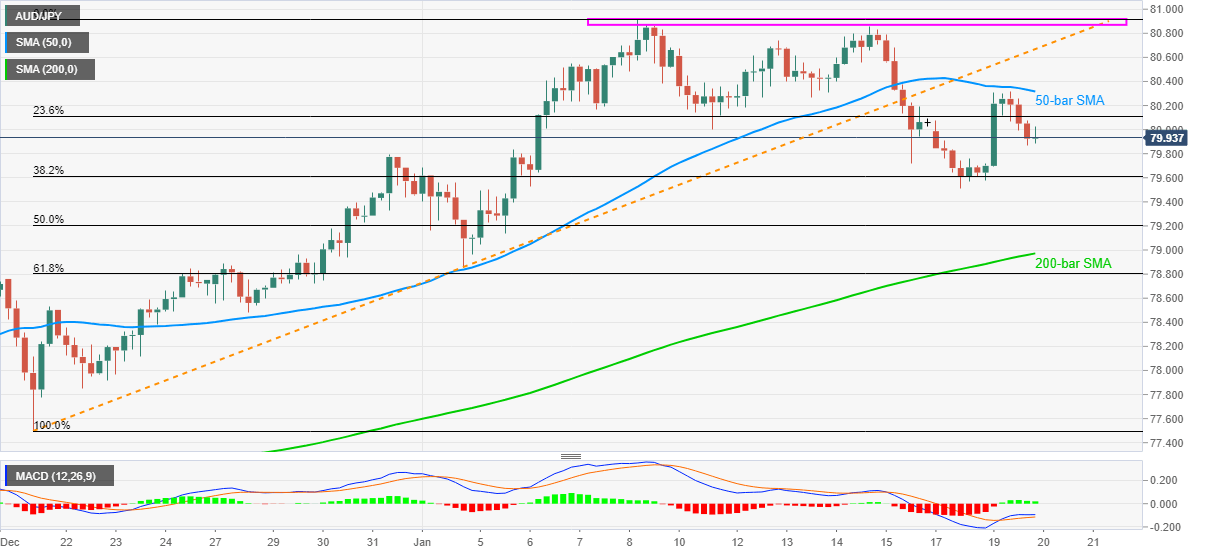

AUD/JPY Price Analysis: Bears keep the reins around 80.00

- AUD/JPY fades pullback from 50-bar SMA, keeps bearish signals.

- Double top confirmation, sustained break of one-month-old rising trend line favor bears.

- Key Fibonacci retracement levels, 200-bar SMA add to the downside filters.

AUD/JPY battles 80.00 in a recent recovery move during the initial Asian session on Wednesday. The quote earlier took a U-turn from 50-bar SMA while trying to reverse the key support break portrayed on Monday.

Despite the pair’s recent bounce off 79.86, the 50-bar SMA near 80.30 probes short-term AUD/JPY buyers ahead of the previous support line near 80.66.

In a case where the AUD/JPY prices rise past-80.66, the double top formation around 80.85-92 and the 81.00 round-figure will be the key to watch.

Meanwhile, 38.2% Fibonacci retracement of December 21 to January 08 upside, near 79.60, can challenge intraday sellers of AUD/JPY.

Also acting as the key support are 200-bar SMA and 61.8% Fibonacci retracement level, respectively around 79.00 and 78.80.

Overall, AUD/JPY may witness corrective pullback but the bulls aren’t likely to regain the controls.

AUD/JPY four-hour chart

Trend: Bearish