Our best spreads and conditions

About platform

About platform

Sellers seems to have turned up around the greenback and lift EUR/USD back above the 1.2100 mark on turnaround Tuesday.

EUR/USD finally regains the smile following four consecutive daily pullbacks and looks to extend the rebound from Monday’s new 2021 lows in the mid-1.2500s.

The softer tone surrounding the buck gives extra legs to the recovery in EUR/USD beyond 1.2100 the figure, while positive results from the euro area also collaborates with the bid bias in EUR.

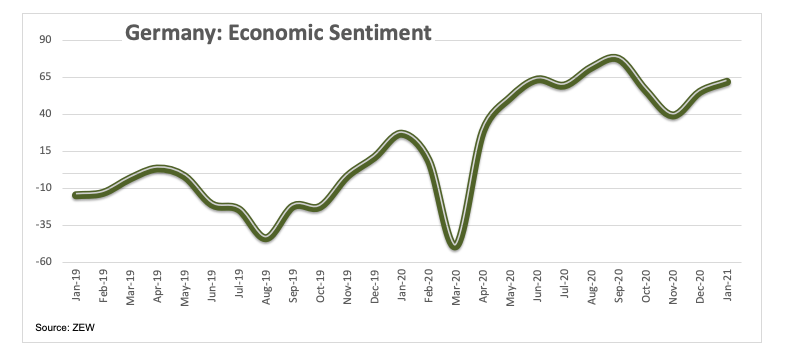

In fact, and tracked by the ZEW survey, the Economic Sentiment in Germany improved to 61.8 for the month of January and rose to 58.3 in the broader euro area, confirming the upbeat morale in the region amidst the vaccine rollout and despite rising coronavirus cases.

Across the pond, ex Fed Chief Janet Yellen will testify before the Senate Finance Committee, as President-elect Joe Biden nominated her to Treasury Secretary.

In the US data space, November’s TIC Flows will be the only release later on Monday.

The leg lower in EUR/USD seems to have met decent contention in the mid-1.2000s for the time being. Despite the recent corrective downside, the outlook for EUR/USD remains constructive and appears supported by prospects of a strong recovery in the region (and abroad), which is in turn underpinned by extra fiscal stimulus by the Fed and the ECB. In addition, real interest rates continue to favour the euro area vs. the US, which is also another factor supporting the EUR along with the huge long positioning in the speculative community.

At the moment, the pair is up 0.47% at 1.2131 and a break above 1.2349 (2021 high Jan.6) would target 1.2413 (monthly high Apr.17 2018) en route to 1.2476 (monthly high Mar.27 2018). On the flip side, the next support is located at 1.2046 (55-day SMA) seconded by 1.2053 (2021 low Jan.18) and finally 1.1976 (50% Fibo of the November-January rally).