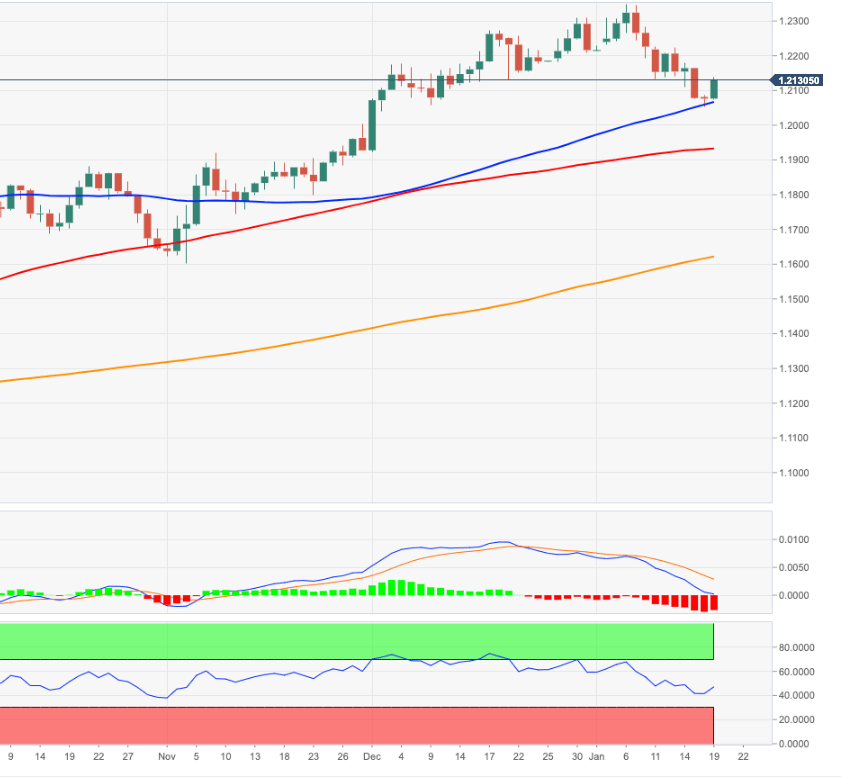

EUR/USD Price Analysis: Interim resistance aligns at 1.2173

- EUR/USD rebounds from yearly lows in the 1.2050/55 band.

- The recovery targets the Fibo level around 1.2170.

EUR/USD reclaims the 1.2100 mark and above on Tuesday, coming back from the area of 2021 lows in the mid-1.2000s.

If the recovery picks up extra steam, then the next interim hurdle emerges at the Fibo retracement (of the November-January rally) at 1.2173. Further up, there are no relevant levels until the YTD peaks in the 1.2350 zone.

On the broader picture, the constructive stance in EUR/USD remains unchanged while above the critical 200-day SMA, today at 1.1608.

Looking at the monthly chart, the (solid) breakout of the 2008-2020 line is a big bullish event and should underpin the continuation of the current trend in the longer run.

EUR/USD daily chart