Back

8 Jan 2021

Crude Oil Futures: Further upside on the table

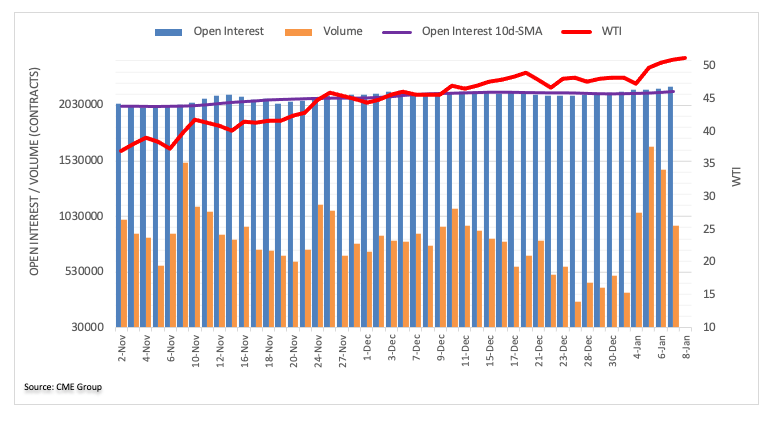

CME Group’s advanced readings for crude oil futures markets noted traders added around 18.6K contracts to their open interest positions on Thursday, reaching the second build in a row. Volume, instead, went down for the second consecutive session, now by around 502.2K contracts.

WTI looks firmer and targets $54.00

Prices of the WTI keeps the rally well and sound. Thursday’s positive performance was in tandem with rising open interest, which should be supportive of further upside in the very near-term. Against this, the February peaks near $54.50 now emerge as the next target of relevance.