Our best spreads and conditions

About platform

About platform

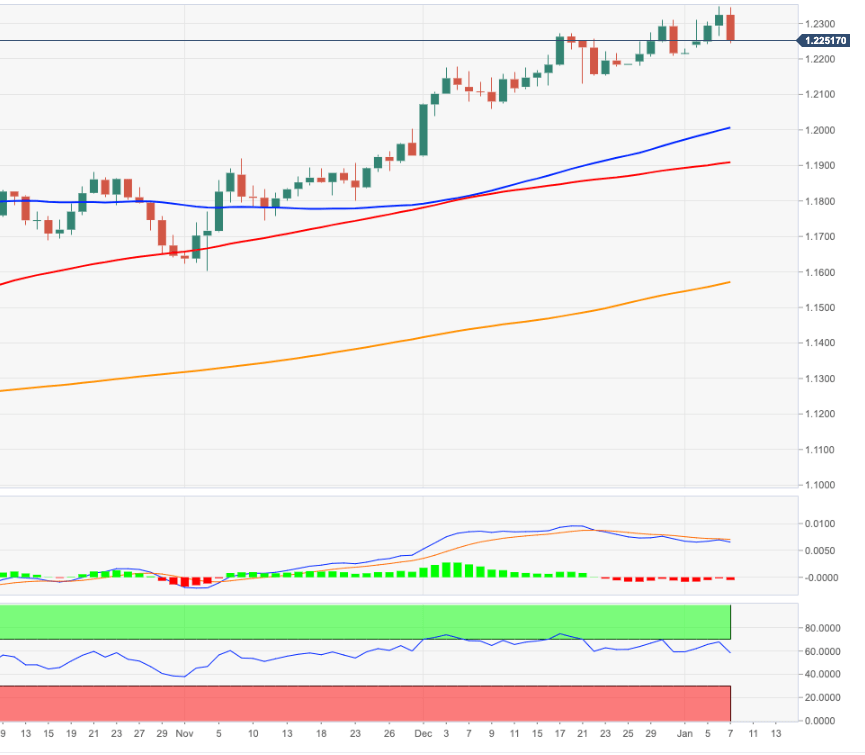

EUR/USD gives away part of the recent advance beyond 1.23 the figure and retreats to the mid-1.2200s against the backdrop of the so far moderate recovery in the greenback.

Against this, EUR/USD now risks a probable move to the 21-day SMA just above 1.2200, while a deeper pullback could see the weekly low at 1.2129 (December 21) re-visited in the short-term horizon.

In the meantime, extra gains in EUR/USD are likely while above the critical 200-day SMA, today at 1.1557.

Looking at the monthly chart, the (solid) breakout of the 2008-2020 line is a big bullish event and should underpin the continuation of the current trend.