Back

7 Jan 2021

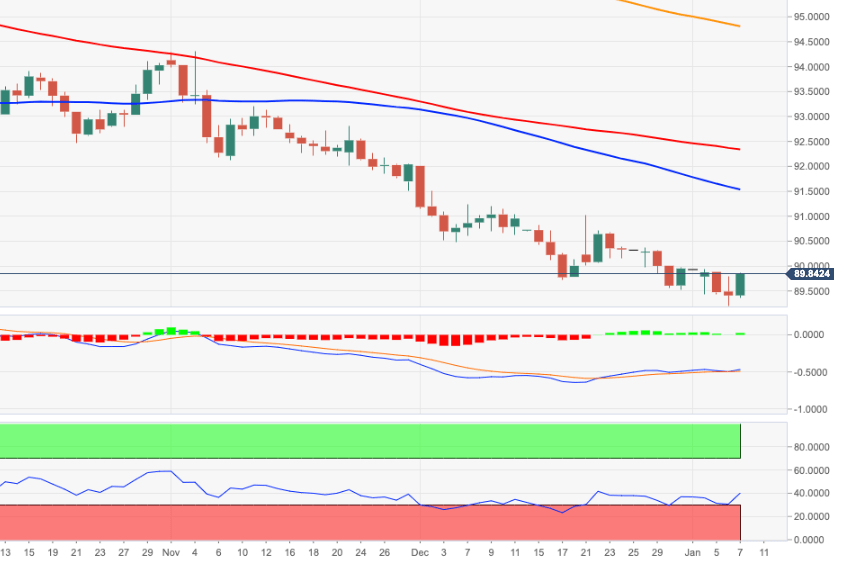

US Dollar Index Price Analysis: Interim resistance emerges at 90.16

- DXY manages to reclaim recent ground lost and approaches 90.00.

- Further recovery targets the minor hurdle at the 21-day SMA at 90.16.

After bottoming out in fresh lows around 89.20 on Wednesday, the dollar managed to regain some buying attention and is now trading at shouting distance from the key 90.00 mark.

Despite the ongoing rebound, the prospect for the greenback remains negative, with further losses now seen challenging the 89.00 support ahead of the March 2018 low at 88.94.

If the bullish attempt picks up pace, then there is a minor resistance at the 21-day SMA today at 90.16. Furthermore, the downside pressure is expected to mitigate somewhat on a breakout of the weekly high in the 91.00 region (December 21).

In the longer run, as long as DXY trades below the 200-day SMA, today at 94.80, the negative view is forecast to prevail.

DXY daily chart