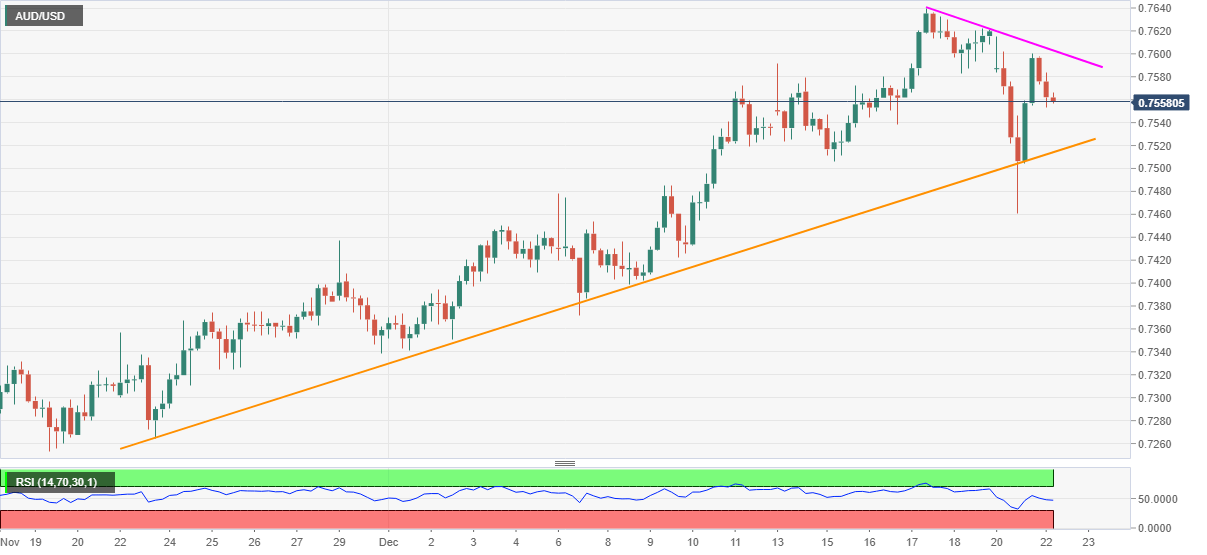

AUD/USD Price Analysis: Teases intraday low near 0.7550, monthly support line defends bulls

- AUD/USD wavers around intraday low, fades bounces off short-term support line.

- Normal RSI conditions, failure to cross three-day-old resistance line keep sellers hopeful.

AUD/USD drops to 0.7560, down 0.28% intraday, while heading into Tuesday’s European session. The aussie pair took a U-turn from an upward sloping trend line from November 23 the previous day.

However, the corrective recovery cools off-late, amid normal RSI conditions, which in turn suggests another attempt to break the stated support line, at 0.7515 now.

Although AUD/USD buyers are likely to return around the 0.7500 threshold, any mistakes will recall the early-month peak surrounding 0.7450.

Meanwhile, a downward slopping trend line from last Thursday, currently around the 0.7600 round-figure, guards the pair’s immediate upside.

Should AUD/USD bulls manage to conquer the 0.7600 hurdle, the monthly peak of 0.7640 holds the key to a fresh high since June 2018, around 0.7680.

AUD/USD four-hour chart

Trend: Further weakness expected