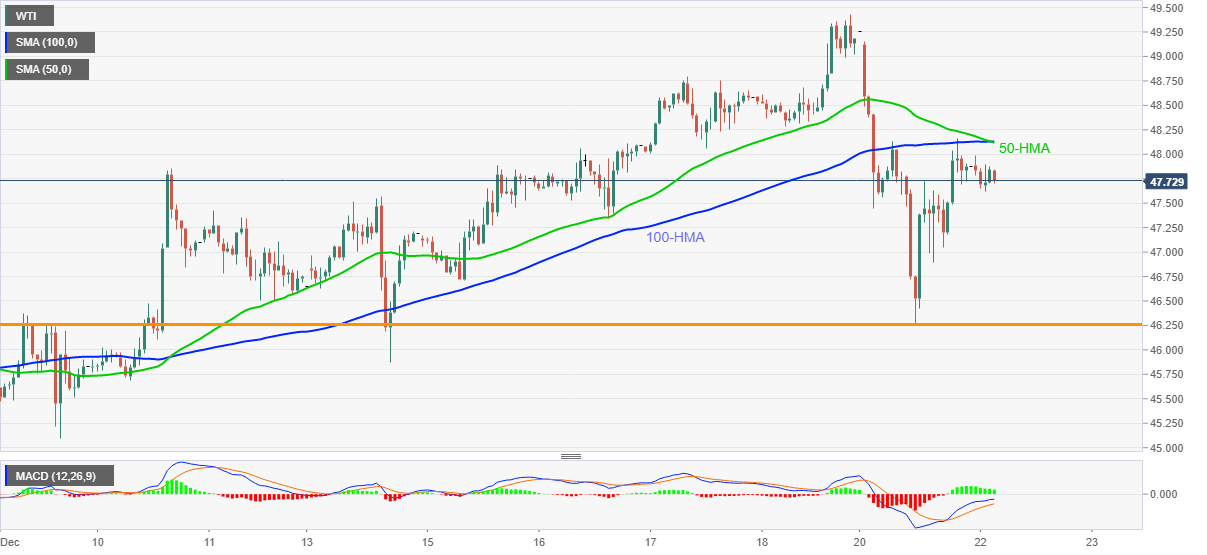

WTI Price Analysis: 50/100-HMA confluence guards immediate upside

- WTI prints mild losses while declining below $48.00.

- Receding MACD histogram, strong upside hurdle challenge bulls.

- Two-week-old horizontal support restricts short-term declines, buyers can remain hopeful beyond August top.

WTI eases to $47.79, down 0.10% intraday, during early Tuesday. The energy benchmark posted the biggest daily losses in six weeks the previous day. Though, a horizontal line comprising multiple levels since December 09 restricted further downside.

It should, however, be noted that the corrective recovery beyond the stated support line fails to cross a confluence of 50 and 100-HMAs. The receding upside momentum also takes clues from the MACD histogram, which in turn suggests the immediate weakness of the black gold.

As a result, the $47.00 threshold can lure the oil sellers ahead of directing them to the aforementioned support near $46.25. Though, any further weakness will not hesitate to challenge the monthly low near $44.00.

However, WTI buyers are likely to remain hopeful unless witnessing a daily closing below August month’s top near $43.85.

On the contrary, a clear break above the SMA convergence near $48.15 will quickly challenge the multi-month peak, marked last Friday, near $49.45.

Overall, the energy prices are in an uptrend that eyes the $50.00 threshold.

WTI hourly chart

Trend: Bullish