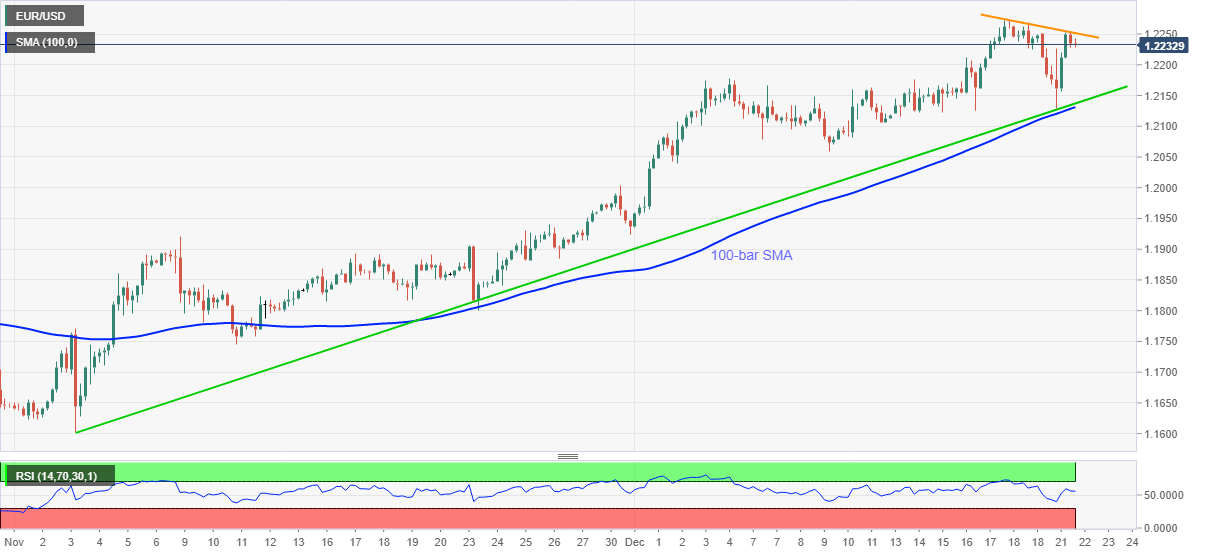

EUR/USD Price Analysis: Fades bounce off seven-week-old support line, 100-bar SMA

- EUR/USD consolidates recent gains above 1.2200, follows three-day-old falling trend line while easing off-late.

- RSI conditions, ability to stay above the key supports keep buyers hopeful.

EUR/USD takes rounds to 1.2230 during Tuesday’s Asian session. In doing so, the major currency pair maintains the lower high formation from the last Thursday, as portrayed by a short-term resistance line.

However, strong RSI and the pair’s ability to bounce off an ascending trend line from November 04 as well as 100-bar SMA keeps the EUR/USD buyers hopeful of clearing the immediate hurdle, around 1.2140.

Following that, the monthly high near 1.2275 will be the key as any further north-run will not hesitate to challenge the April 2018 peak surrounding 1.2400.

Meanwhile, the early December tops near 1.2175 can offer immediate support ahead of the stated confluence of the trend line and SMA, around 1.2130.

In a case where EUR/USD sellers manage to break the 1.2130 support joint, 1.2040 can offer an intermediate halt before highlighting the 1.2000 psychological magnet.

EUR/USD four-hour chart

Trend: Bullish